About 80% of Forex market traders suffer losses,the reason for which are the mistakes they made when making decisions. The lack of financial analysis tools or the knowledge necessary to interpret its results affects the rationality of their actions. Moreover, a great variety of tools for technical analysis of the foreign exchange market can confuse a novice investor.

Technical Analysis Tools

Understand the dynamics of the market will help effectivedata analysis tools, among which are indicators of trend change. Their goal is to reflect the trend of currency market rate dynamics. The trend indicator may indicate its direction (ascending, descending and lateral), force and reversal. There are the following indices:

- trend indicator;

- the moment or rate of change of the rate of the previous period to the current rate;

- volatility or variability of the exchange rate;

- the volume of trades;

- support and resistance.

Trend Indices

The best trend indicators are as follows:

- Moving averages (MA), simple SMA, exponential EMA and weighted WMA;

- convergence-divergence moving average MACD (English MA convergence / divergence)

- TRIX (English triple EMA, triple EMA);

- Directional movement (DX);

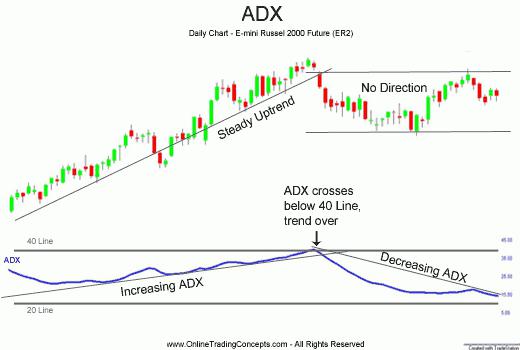

- Medium DX (ADX);

- trend line indicator;

- commodity channel (CCI);

- parabolic SAR (English stop & reverse, stop and reverse);

- SMI (English smart money index, index of "smart" money);

- vortex (Vortex indicator, VI);

- Ichimoku trend indicator.

Trend indexes help to trade in itsdirection, keeping long positions in the conditions of an uptrend and short for a downtrend. The disadvantage of these indicators is the lag at the time of the reversal of the market trend.

The moment indices

Avoid the delay by using indicatorsmoment. They help to establish a turn around the lower or upper boundaries of the horizontal trend channel, the moments of resale and repurchase. The disadvantage of the torque indicators is premature signaling of the sale with an increasing trend and about buying with a falling trend. These include indicators:

- stochastic;

- force (English force index, FI);

- true strength (TSI);

- relative strength (RSI);

- ultimate (English ultimate oscillator, UOS);

- cash flow (English money flow index, MFI);

- Williams' percentage range (English Williams% R,% R).

There are also psychological indices Forex:a bullish consensus agreement, an engagement of traders (COT) that assess the overall market situation, its inclination to fall or rise in quotes.

The indices of the trend and the moment often do not coincide inforecasts. For example, with a long-term growth of the trend, the trend direction indicator increases, signaling the purchase. At the same time, the moment oscillators give a signal about repurchase, offering to sell. The reverse situation is observed in the period of a prolonged fall in prices, when the indicator of the direction of the trend is lowered, signaling the sale. In this case, the indicators of the rate of change in prices insist on buying.

Indicator of the strength of the trend

The strength of the growing trend can be estimated by its volume,direction and distance. When the closing rate is higher than the previous one, the strength of the trend is positive. And vice versa. The more the course has changed, the stronger the trend. The indicator of the strength of the trend is calculated by the product of the difference between the last and the previous price when closing on the volume of the currency. Thus, the strengthening of the trend is determined by an increase in the price or volume of trading. It varies from -100% to 100%.

RSI indicator

The relative strength indicator RSI is calculatedas the ratio of the moving average of positive changes in the closing rate for the period to the sum of the moving averages of positive and negative changes of the same price multiplied by 100. When the index value approaches 100%, the indicator signals overbought currency, and to 0% - its oversold. The extreme of the index chart, opposite to the direction of price movement, is the trend reversal indicator. Conversely, if the price chart shows a new high on an upward trend, and the index does not change, then a reversal is expected. To determine the trend change to the chart of the indicator, you can apply figures of technical analysis. Also, the signal of the trend reversal is the convergence and divergence of the indicator chart and the price - the price follows in the direction of the relative strength index.

For example, a trader enters a long position ifThe MA50 exceeds MA200, and the 3-day RSI falls below the set value of 20%, indicating oversold. Conversely, a trader enters a short position if MA50 is lower than MA200 and RSI3 rises above a set level of 80%, signaling an overbought currency.

MACD indicator

The MACD trend indicator is built on the differenceexponential moving averages of a smaller and longer period. Usually use 12 and 26-day sliding. At MA intersections, it is judged about changes in the trend of different time periods, and by distance and relative position - about the stability of an upward or downward trend. Subtraction from the short-term moving long-term gives an oscillator that visibly takes into account these features. The indicator is a kind of analysis of two averages.

There is a histogram and linear MACD indicator.

The MACD histogram indicator is calculated by the formula: MACD = EMA9 [A], where A = EMA12 [i] - EMA26[i], where i is the price.

There are 3 types of signals:

- the passage of the maximum or minimum MACD is a signal, which should be reacted when several additional ones are received;

- crossing the MACD of the established border is the basis for opening the position;

- The intersection of the middle MACD also requires additional signals.

Signals confirming the signals of MACD-histograms are volume indicators. It is also advised to wait for the course to change in the direction of the forecast.

The linear MACD consists of a smoothed and not flattened A. These lines repeat the dynamics of the course.

Crossing the 12-day line with a 26-day top-down signals the sale, the bottom-up - about the purchase.

The value following the minimum or maximum of the 12-day line is a warning requiring confirmation in the form of intersection of MACD lines.

The intersection of a linear MACD with a value boundary requires at least 2 confirmation signals.

The indicator should be used on charts not less than daytime. May be significantly delayed.

Parabolic SAR

Parabolic SAR, when the course is changingthe trend of the market enters a new extremum, changes MA of the stop limits to short-term (from 50 to 5 days), and the stop and reversal rate converges with the trend. The indicator repeats the trend to the intersection of the SAR level with the closing of the current position and the opening of the opposite position.

The initial course is equal to the previous minimum (maximum) rate. The SAR is then calculated as follows: SARn + 1 = SARp + AF (M-SARMr.), where:

- SARn + 1 - this is the stop-price of the open position,

- SARMr. Is the SAR of the previous period,

- AF is the acceleration increasing from 0.02 to 0.02 when the course reaches M.

- M is the new maximum (minimum) rate.

The parabolic system is used both to determine the moment of closing the position, and to open positions.

Commodity Channel Indicator

The commodity channel indicator is a measure of price momentum and is calculated as the quotient of the price difference and its moving average from the absolute price deviation multiplied by the coefficient of reduction.

- CCI = (PMr. - SMA (PMr.)) / 0,015D, where:

- PMr. - typical price;

- SMA (PMr.) - the moving average of a typical price;

- D is the mean of the absolute difference in the mean exchange rate and its SMA.

CCI values range from +/- 100. In this case, the excess of 100 indicates overbought currency, and -100 - about oversold, and this indicator of the trend reversal.

It is generally accepted that over 100is random and creates an opportunity for a transaction. Buy should be in excess of CCI 100, and sell when the index goes below 100. It is recommended to open a short position with CCI values less than -100 and close above -100.

Indicators MA

Moving averages are simple, weighted and exponential.

A simple MA corresponds to the average of the arithmetic rate for the period.

This is the simplest and most popular indicator,showing the trend. For example, the 200-day SMA remained a popular and effective tool for analyzing Forex quotations for decades. It is calculated by summing the closing rates for the past 200-day period and dividing its number of days. Analysts have simplified the calculation, composing closing courses for 40 weeks and dividing the result by 40.

To calculate the next MA value, you must subtract the value of the closing rate of 40-week-old, add the last closing rate and divide by 40.

The intersection of MA lines of different periodicity makes it possible to calculate the moment of the trend reversal. For example, the intersection point SMA9 and SMA14 signals a trend change.

The drawback of the method is the constant delay of signals, and its advantage is the simplicity and the possibility of using SAM lines as resistance and support lines.

WMA index

Weighted moving averages to each course of the period give weight, which decreases as you move away from the current day:

- WMA = 2Σ (n-i) Pt-i / (n (n + 1)), where:

- Pt-i - the value of the course at the time removed by i intervals from the current one;

- n is the number of intervals.

The making of late courses of more weight is considered to be more informative than SMA. For long periods, apply SMA, and for short (not more than an hour) - WMA or EMA.

EMA Index

The exponential mean is also calculated by assigning weights to the rates taking into account all the rates of the previous period:

- EMAt = EMAt-1 + (K [Pt - EMAt-1 ]), where:

- K = 2 / (n + 1), where n is the average period.

Thus, the moving average curve is smoothed relative to the courses.

At 1 course change MA reacts twice - atreceipt and retirement values. EMA reacts once when receiving a course, which makes the indicator more preferable. Also, EMA allows you to open positions on time.

In the analysis, one should find the intersections of the meanand the course schedule, find the points after the maximum or minimum of the mean, maximum divergence MA and price. And also follow the direction of the indicator MA, which indicates the direction of the trend.

Stochastic Oscillator

Stochastic oscillator is an indicator of the rate of change in price. Calculated by the ratio of the difference in the current closing price Pt and the minimum price LMr. for the period n to the difference between the maximum HMr. and the minimum price of the period LMr., multiplied by 100%:

-% K = 100 (Pt-LMr.) / (HMr.-LMr.).

The three-day moving average of the last three values of% K is calculated as follows:

-% D = 100 ((K1+ K2+ K3) / 3).

In addition to the simple average, both exponential and weighted mean can be used.

Indicator when discarding old data canChange jumpwise, which leads to instability and the supply of erroneous signals. Therefore, if you require an accurate trend indicator, then this oscillator is not the best choice.

If there is a discrepancy between% K and the rate, a turn is expectedtrend. If the rate reaches the next maximum without a maximum of% K, then we can expect that the downtrend will change ascending. Conversely, if the rate reaches a minimum, and% K does not, then you should expect a trend reversal upward.

The signal to buy is the elevation of% K over% D,and for sale,% K drops below% D. According to the developer, the signal is more reliable if% D has already turned in the direction of the new trend before crossing the% K. The most reliable are buy signals in the region of 10-15% and sale signals in the region of 85-90%.

Trend reversal indicator without redrawing

The algorithms for calculating indicators are usedhistorical data. Each new price removes the first price of the accounting period. Even the best trend indicators, recalculating the values for the new history, can change their previous values. Such a change in values when new data is received is called indicator redrawing.

This effect is observed in most Forex indices, therefore, to reduce the impact of such changes, an indicator of the trend reversal without redrawing is necessary.

The lack of redrawing always needs to be checked.on their own due to the fact that the expression “no redrawing” has gained popularity and is used without sufficient reason by the developers of free and paid indicators to advertise their products.

You can check the absence of redrawing visually in two ways:

- monitor the indicator on a small timeframe;

- use on M30 and higher timeframes to speed up the procedure of the testing software of the trading platform, which can speed up the indicator tracking time

Индикатор разворота тренда без перерисовки – An interesting and profitable tool for technical analysis, but you need to take into account the fact that redrawing is not always a disadvantage. It becomes a consequence of a change in the market situation, and the “lost” signal could be false.

Williams fractals are an example of whatredrawing may be useful. When the indicator appears, you should wait for its confirmation: if the fractal includes 5 candles, it is recommended to open the transaction in the absence of its redrawing within the next two candles. And the trend indicator without redrawing will deprive the trader of such a tool, or, instilling in him a false sense of reliability, will lead to losses.