Many people familiar with the "Forex" or other markets(stock, resource) have an idea of various strategies, as well as technical and fundamental analysis. There are a huge number of them, from the simplest signals to the most complicated systems, consisting of a set of interacting indicators and oscillators.

What it is?

The described tool is one of the waysfor the implementation of technical analysis, but it is very specific and requires the trader special knowledge to carry out transactions. In addition, its use is better combined with other methods of market research, for example, multiframe analysis and trading volume indicators, but any system of making deals is individual for everyone.

The essence of this tool

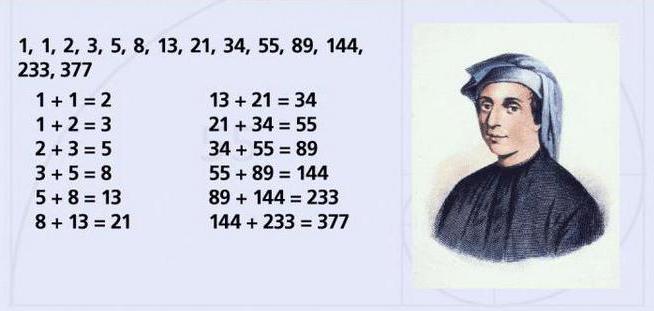

Fibonacci Time Zones are a certain sequence of lines that are constructed vertically and are located in special numerical intervals (note 1, 2, 3, 5, 8, ... n) and so on up to infinity, but usually ends at 89 or 144, depending on the specified parameters.

When this indicator is superimposed on the terminalIts main line passes through the smallest or largest point of the graph. The subsequent bands emanate from it with increasing intervals, corresponding to a special mathematical sequence, which is followed by the Fibonacci time zones. Then it remains only to analyze the information received.

Fibonacci time zones: how to use?

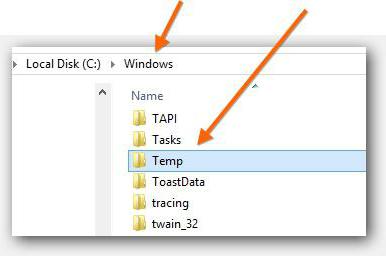

Before you start working with thisindicator, it is important to find the points of the price turn and select the most powerful situation on the chart, associated with the trend changes. Once you have found a price change, use the provided tool in your broker's terminal or on a third-party resource. As a rule, it is called "Fibonacci time zones "(sometimes periods), then you should connect the found price reversal points - and you will see zones of potential changes in the future.

However, it should be remembered that this is justpossible levels of price behavior dynamics, so the lines will not give any guarantee that these changes are mandatory. In addition, you should not trade using only Fibonacci time zones, since this tool does not give a complete picture of the market. But it can be used as a source of information for a particular strategy, using other indicators, for example, the relative strength index, moving averages, and many different popular forecasting methods.

The most important thing in this method is to search for the primary interval for the entry, and also the fact that the periods give the best result on large time frames (hour, 4-hour, daily, weekly charts).

There are other "Forex" strategies.They are quite specific. Many of them do not use Fibonacci time zones, but they can be combined, thus filtering transactions and getting additional information about the state of the market. In the case of foreign exchange trading, any information is never superfluous.

Also remember the high risk of such operations and follow common sense.