As everyone knows, volatility representsthe level of variability in prices. In order to determine the possible risk, you need to know everything related to this indicator. By monitoring the level of volatility, you can see how the value of a currency begins to change dramatically in a certain time period. This means that its level is high. If the price does not change much, but only small fluctuations are observed, this indicates a low volatility. How correctly to measure its level?

For this purpose, specialdiagrams or oscillators. With their help, you can follow the market fluctuations in different periods of time: both for weeks and months, and for hours and even minutes. For example, traders actively use a tool such as ATR. What is it and how does it work?

What is ATR and what is it created for?

Indicator Average True Range, or ATR, wasdeveloped by Welles Wilder specifically to determine the volatility of price changes. From the very beginning, it was used in the commodity market, where this characteristic is more common, but at present it is widely used among currency traders. At Forex, however, it is rarely used to discern the future direction of the price movement. More often it is needed only to get an idea of the recent volatility in order to prepare a future trade plan. Setting stops and entry points at profitable levels to prevent exit or quick turns is considered an advantage of this indicator.

Essence and Understanding Average True Range

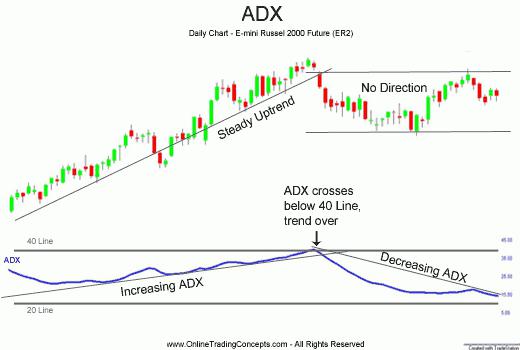

The ATR indicator is classified as an "oscillator",since in the display results the curve fluctuates between the indices calculated on the basis of the level of price volatility for the selected period. It is not a leading indicator, because it does not display anything related to the direction of the price. High values of the diagram suggest that the frames for the "stop" can be wider, as well as the entry points. This allows you to prevent the movement of the market against you. By reading ATR, a trader can effectively act with strategies that monitor commensurate levels of price movement.

ATR indicator: formula

The ATR indicator is common, functioning ontrading software Metatrader4, and the formula for calculating the sequence includes the following simple steps: for each selected period, calculate three absolute indicators:

a) High minus Low.

b) High minus Close of the previous period.

c) Close the previous period minus Low.

TrueRange, or TR, is the largest threethe above calculations. The ATR indicator is an oscillator that operates on the basis of the moving average for the selected length of the period. A typical installation of this length is "14".

How does this oscillator look like?

Computer programs perform the necessary computational work and reproduce the ATR-indicator in the form of a diagram.

Average True Range consists of one curvefluctuating. For example, when trading with the GBP / USD currency pair, it is advisable to set its range from 5 to 29 points. On the "peaks" seen in the curve, you can visually see the "Candlesticks" expanding in size, which indicates the strength of the market position. If low values are maintained for a certain time period, then the market consolidates, and a breakthrough can be predicted.

How is the schedule displayed?

Understanding how the ATR indicator works(calculation formula, etc.) will allow us to examine in detail how this generator is used in the Forex market and how to read the various graphic signals that are generated on the charts. How to use ATR in the Forex market?

For example, an ATR with a period setting of "14" canPresent on a 15-minute chart for the GBP / USD currency pair. In this diagram, the ATR will be displayed as a red line. The value of this oscillator in this case will vary from 5 to 29 "points".

ATR indicator: how to use Forex?

Key points of reference are lowpoints orlong periods with low values. It is better to work with this indicator for a longer time frame, that is, on a daily basis. However, shorter periods can also be placed, and trading with them can also be successful. It should only be remembered that the ATR indicator is trying to convey price volatility, and does not report on price directions. The oscillator is traditionally used in tandem with other trend or momentum indicators, allowing you to set stops and optimal entry point fields.

Possible errors

As with any technical indicator,an ATR chart will never be 100% reliable. False signals may occur due to the lagging quality of moving averages, but positive signals remain quite consistent. In total, this allows Forex traders to obtain useful information for making transactions. Some experience in the ability to interpret and understand ATR signals must be developed over time. In addition, it is imperative to supplement this tool with any other indicator. This is recommended for further confirmation of possible trend changes.

Understanding the above principles will allow you toillustrate a simple trading system that can be built using the ATR indicator. Setting it includes the above options, divided by periods.

Key points

Forex traders should focus onThe key points and opportunities of ATR, which include the "spikes" lowpoints. Like any technical indicator, this chart has a certain percentage of errors in the signals that it gives out. However, correctly interpreted signals can be quite consistent and useful.

The following trading system is designed inmore for educational purposes. Technical analysis includes the previous price behavior and at the same time tries to predict future prices. However, it is also well known that past results do not guarantee future results with the same market activity. Given this reservation, you should read the constructed graphs. The ATR indicator for Herchik includes the following. The green circles in the diagram illustrate the optimal entry and exit points, and the ovals of the same color indicate a breakthrough or reversal, which is inevitable with the current market trend. This use of ATR analysis is most effective in combination with the blue lines of the RSI indicator.

Conditions

A simple trading system will be implemented under the following conditions.

Determine your entry point when the RSI line drops below the “30” mark (the lower limit of the line), and add 25 “pips” (the ATR value should be “1.5X”).

Set up BuyLimit for no more than 2-3% of your account.

Place a stop loss of 25 "points" (with an ATR value of "1.5x") below the entry point.

Determine the exit point when the RSI crosses the upper limit of the “70” line and is accompanied by a decrease in the ATR value from the previous peak.

Steps "2" and "3" are weighted.principles of risk management and monetary resources that should be used in trading operations. This simple trading system can provide profitable trading on 100 "points". However, it should certainly be remembered that the past is no guarantee for the future. Nevertheless, the study of sequences is your goal, and this data will be successfully provided by technical analysis and ATR indicators.