Technical analysis of the stock market allowsto assess the balance of power "bulls" and "bears" at the current time. Technical analysis emerged as a result of monitoring by traders of the price schedule and identifying the rules of behavior, formed by analyzing the market psychology, repetition of history and other factors.

Technical analysis is carried out using various indicators. Most of the forecasts are made by professional traders after a technical analysis.

Russian securities market is still underdevelopedin comparison with the markets of other countries. The development of the stock market contributes to the expansion of financial instruments. In addition, there are various types of stock markets. The primary stock market involves the issuance and placement of new securities for the first time. Secondary stock market can be organized or unorganized. Equity markets are also classified by territoriality.

Depending on the financialtools trader chooses a broker to gain access to trading. Forex broker rating allows you to estimate the number of financial instruments accessed by a specific broker. Brokers have a different commission and working conditions. Approach to the choice of broker for trading must be deliberately. Forex broker rating includes a comparison of brokers in all important aspects of work.

Differences in fundamental and technical analysis

Fundamental analysis suggests learningfundamental factors affecting the price during the news release and in the long term. The fundamental indicators include: the level of GDP, unemployment, changes in the refinancing rate, etc.

Technical analysis involves analyzing the scheduleprices using indicators, geometric figures, support lines and price resistances. Technical analysis more fully takes into account the psychological aspects of players for the short and medium term. Practically all traders use this type of analysis, while few players use fundamental analysis, which is connected with the need to study a large amount of data to form objective conclusions.

Even after drawing conclusions based ona fundamental analysis of the trader is looking for the most convenient point of entry into the market, using the means of technical analysis. Many traders use special software for technical analysis. The program for analyzing the stock market, as a rule, analyzes the chart and identifies the signals of various indicators. However, most traders analyze charts on their own, without using additional software. Technical analysis of the stock market involves the use of signals from various indicators, while the program gives signals on one or two indicators and does not take into account many other factors, such as the release of important news, etc.

The postulates of technical analysis

The main functions of the market are as follows:

- in the concentration of free cash through the sale of securities;

- in attracting investments through the organization of the purchase of securities of the company;

- in ensuring their high level of liquidity.

The stock market is not an abstract concept,as it may seem. For securities placed for sale, there are real economies of existing organizations that provide jobs, produce goods, works or services, pay taxes.

There are three basic postulates on the stock market that professional traders use to build their trading strategies:

- The price takes into account everything.

- Price moves directionally.

- History repeats itself.

The price takes into account everything.Like currency, Forex, the stock market takes into account not only the state of the country's economy, but also the expectations of traders. Expectations are based on rumors, news and fundamental market analysis, as well as insider information. Analyzing the chart, the trader applies his knowledge, information, indicators and other analysis tools to determine the most likely future direction of price movement.

На цену может повлиять огромнейшее количество various factors, such as: statements by politicians, natural disaster, waiting for the release of important news, etc. All, absolutely all publicly available information is already contained in the price.

Price moves directionally. The stock market, like the forex market, is subject to trends. That is, the price never moves erratically. This is confirmed by the main indicator of technical analysis - the trend.

История повторяется.The psychology of most players implies the existence of certain scenarios of actions that are activated in different situations. It is the repetition of history that helps to highlight common rules for conducting technical analysis of the market.

Technical Analysis Indicators

Technical analysis of the stock market is carried out by building and using the following indicators:

- trend line, support and resistance levels;

- geometric figures;

- technical indicators of a group of oscillators;

- trend technical indicators.

Trend line

Если цена движется вверх или вниз – такое movement can be called a trend. If the price moves sideways, this is a side trend. Trend has several cycles: the birth, development and completion. A trader is looking for signs of an emerging trend to enter the market in its direction. It is necessary to leave the market at the first signs of the end of the trend.

The origin of the trend in the long run, asusually due to fundamental factors. So, the trend can be formed under the influence of important news. One of the postulates of stock trading says: do not play against the trend or play in the direction of the trend. If a trader tries to play against the market, he ultimately finds himself at a loss.

The development of the trend can occur longtime. Trends can last for months and even years. Completion of the trend is also due to fundamental factors. A sign of its completion can be a large price fluctuation in the opposite trend direction. Such a fluctuation indicates that a major player has closed the position.

If you look at the chart below, you cansee a downtrend. A trend line in a downtrend is drawn along price highs. In case of a downtrend, its line is drawn along price minima.

To determine the trend, traders also use additional indicators, for example, moving averages, ADX and others.

Support and Resistance Levels

The resistance level is the line thatprice touched several times and fought back in the opposite direction. For example, a trend line (in the example above) serves as a resistance line. The image shows that the price relates to the trend line, but does not break through it. Near the trend line it is necessary to enter the market in the direction of the trend, provided there are no signs of its completion.

After the price breaks through the resistance line, this line becomes the price support level. This is demonstrated on the price chart below.

Geometric figures

The following figures are used fortechnical analysis of the graph: triangle, rectangle, flag (pennant), head and shoulders, triple top, double and triple bottom, saucer and others.

All figures are divided into two groups:reversal and continuation figures. The reversal figures show the trader the possibility of reversing the current trend, and the continuation figures indicate his most likely further continuation. Most often, the method of geometric figures is not used by itself, but together with other means of analysis.

Technical analysis of the stock market, as well as the marketForex involves the use of geometric shapes, due to the recurring behavior of most traders in the event of their occurrence on the chart. Both in the stock market and in the foreign exchange market, this analysis technique is widespread.

Triangle. There are four types of triangles,used to predict price behavior: descending, ascending, symmetrical and expanding triangles. This figure belongs to the reversal group. Before entering the market, when forming this figure on the price chart, you need to wait for the breakdown of its boundaries.

Rectangle. This figure is formed when clear horizontal support and resistance lines appear on the chart. The rectangle indicates the balance of power in the market.

"Flag" or "pennant". These are continuation trend figures. The appearance of a flag or pennant on the price chart is accompanied by a correction of the trend movement.

"Head and shoulders". Эта фигура имеет большое значение при образовании on the daily chart. In smaller timeframes, a small number of traders work, which means the reaction to the formation of a figure below. The figure belongs to the turn group. Also in technical analysis, the “inverted head and shoulders” figure is often used, which in this case is called a “double bottom”.

"Triple Top". This figure belongs to the turning group and forms three peaks in the same price level.

"Double and triple bottom." This model is opposite to the “triple top” figure. Price outlines three lows in the same range.

"Saucer". Pivot model trend. The most important is on long timeframes - daily, weekly chart. The formation of this figure may take more than a month.

Trend Indicators

Determining the direction of the trend plays a crucial role in trading. The game against the market rarely ends in profit. Technical analysis of the stock market is very similar to currency analysis.

Moving average Moving average or MA are the mostimportant trend indicator. This indicator visually represents a line that is built at average prices for a specified period. When building this indicator, closing prices are the most important.

In the investment market there is a saying:“The market is opened by amateurs, but by professionals.” It fully reflects the importance of closing prices. Professional traders open deals for large sums and have a strong influence on the price. It is for these reasons that closing prices are given the greatest value.

The most popular type of MA aresimple, exponential and weighted moving average. Simple moving average (SMA) is based on the arithmetic average for the selected period of time. The weighted moving average (WMA) is constructed taking into account the coefficient of "weight", i.e. the latest prices are taken into account most fully. The exponential moving average (EMA) is similar to WMA, but takes into account all prices from the previous period.

Обычно трейдеры используют две MA разного периода.In this case, the buy signal is considered to be the intersection of fast MA and slow MA from bottom to top. A sell signal is the intersection of fast MA and slow MA from top to bottom.

Oscillators group indicators

Oscillators measure market volume.This group of indicators identifies overbought and oversold zones in which reversal is most likely. Indicators of this group give the clearest signals in the trend movement of prices within the channel.

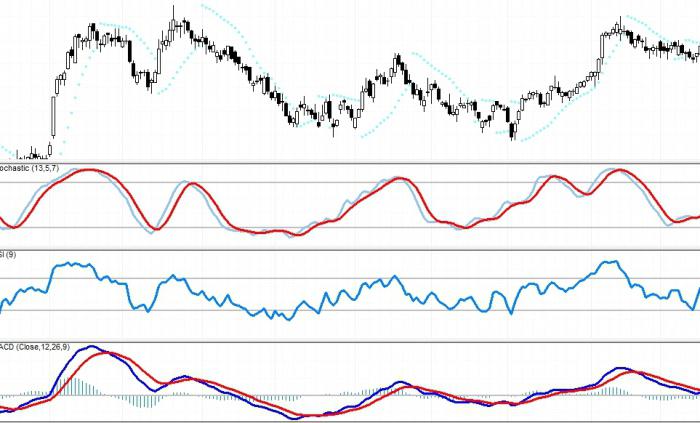

Наиболее популярными среди трейдеров Oscillators are the following: MACD, Stochastics Oscillator, RSI and others. These indicators are used in the technical analysis of not only the stock market, but also the foreign exchange market.

MACD indicator. Этот индикатор строится на основе данных средних sliding different periods and is intended to determine the price reversal. It stands for: “MovingAverageConvergence / Divergence”, which translates as “Convergence / Divergence of Moving Averages”.

The formula for calculating this indicator is as follows: MACD = Fast EMA - Slow EMA.

The properties of this oscillator provide the “fast” and “slow” fields, which correspond to the fast and slow EMA period.

Когда цена находится выше нулевой отметки этого indicator grows, it says upward price movement, and vice versa, if the price is below zero and falls, it says downward movement.

The signal of this indicator is considered to be the price crossing the zero level. So, crossing the zero mark from bottom to top is a signal to buy, and from top to bottom a signal to sell.

If the indicator shows a false price movement (divergence), then this serves as a signal for price reversal.

Indicator Stochastics Oscillator. Stochastics (Stochastic) takes into account not only pricesclosing, but also local maxima and minima. This indicator is more informative than other indicators of a group of oscillators. This indicator provides an overbought zone, which is located above the “80” level, and an oversold zone, which is located below the “20” level.

The signal to enter the market is the intersection of two lines similar to the signals of the MACD indicator. The divergence on this oscillator also serves as a strong signal to enter the market.

RSI indicator. The main parameter of this indicator isthe period for which it is built. The recommended author value is 14, but periods 9 and 12 are also often used. This indicator is used to measure the strength of a trend. He compares the rate of growth and the fall in prices over a selected period of time.

If the indicator line is up, thistalks about the prevalence of a growing trend in the market, and vice versa. Conventionally, the balance of power, that is, equilibrium in the market, is reached at 50. The intersection of the level 50 line from the top downwards serves as a signal to open a short position for sale. The intersection of level 50 from the bottom up is a buy signal.

Finally

Technical analysis of the stock market impliesthe presence of such indicators, which are applied only in this market, include: NH-L, TRIN, MAS and others. Often used to analyze the Forex indicators that were listed in this article. Technical analysis of the stock market involves the simultaneous use of several indicators that can complement each other. But other factors should be taken into account in price forecasting.

Рынок Форекс специфичен.Trading on the currency exchange is a currency rate speculation. Forex currency is traded in pairs, for example EUR / USD, GBP / USD. At the same time, Forex-indicators are used in the stock market. The stock market is an abstract concept, but it is closely related to the currency exchange. In case of a large purchase of shares, the currency is used, which immediately affects its price. At the same time, a sharp depreciation of the currency can greatly affect the stocks of many companies.