One of the most important and significant posts atThe company is an accountant. That he is responsible for all finances and calculations. It is believed that only with a good accountant, a company can become successful.

General Provisions

Specialists in this position arerepresentatives of a professional group. Only the management can appoint them or remove from a post. Especially if the position is considered "leading accountant". All appointments must be made with strict compliance with the laws of the country. He must obey the chief accounting authority.

Functions

The lead accountant must keep records of allirreversible assets in their entirety. He also takes into account all funds, assets, stocks. His responsibilities include control over the capital of the organization. All actions must comply with the organization’s regulations, taking into account its scope and technologies for data processing.

The duties of the lead accountant also includesproviding management with accurate and complete information contained in the primary type of documents relating to accounting. Having coordinated his actions with his superiors, he must personally cooperate with the banks, making payments on behalf of the company, including taxes, payments on credit agreements, etc.

During the inventory he mustself-regulate the process of work. He also takes part in the processing of data that is directly related to the reimbursement of losses due to losses, thefts and damage to the property of the organization, its branches and other structures belonging to the enterprise.

Job Description: Lead Accountantimplies that he will prepare the data, then to bring them into the financial statements. It should also create and prepare, in accordance with the requirements, periodic reporting of all types and forms based on accounting data. It must prepare the processed documentation, report data and information contained in registries in order to save it.

When accountant participation is required

The participation of an accountant is necessary in the preparation of proposals to management in such situations:

- if you need to make changes to accounting policies, to modernize business or other management accounting, improve it, or change the rules for the circulation of documentation;

- if it is necessary to conduct the development of additional systems, including accounts and registers of reports, analytics or management of business operations;

- if it is necessary to ensure the safety of property, to check how effectively and efficiently resources of a material, labor or financial type are used;

- if you need to control the receipt or payment of the credit obligations of the enterprise.

Such requirements are put forward to the employee job description of the lead accountant.

Duties

In addition, the job description leadingthe accountant implies that he will constantly monitor changes and study the documents of the regulatory and reference staff relating to the maintenance and organization of accounting records. Also, based on his own conclusions and analysis of the proposed information, he will propose the introduction of certain changes in the organization. In some cases, he will have to carry out the instructions of his leadership, offered to him in private.

Rights

Job description of the lead accountant of a government institution implies that the employee has certain rights, namely:

- he can study draft decisions of the management of the organization, directly related to his official duties;

- he can make and offer hisdirect management of methods and measures capable of improving and making more efficient the performance of his job duties, as stipulated by the official list;

- given the competence of the position, the employee maynotify management of any deficiencies that in his opinion impair the company's operations; if any, propose their own solutions to eliminate the problems encountered;

- if necessary, request documentation from his superiors, or any other information that is necessary for him to carry out his direct duties;

- also job description for the lead accountantimplies that, if necessary, he can attract any specialist from all divisions of the organization where he works to help him accomplish the tasks entrusted to him by the management;

- if necessary, he may request the assistance of management in carrying out the duties that it has assigned to him.

A responsibility

Job Description: Lead Accountantbudgetary institution of culture and other enterprises implies that a specialist in this position is responsible for the performance of their duties. He should be responsible for his actions in accordance with state law. He is responsible for any offenses that are carried out during the performance of their duties under this instruction. And he can be attracted by administrative, civil and criminal responsibility, depending on what kind of offense he commits. Also, the lead accountant is responsible for any material damage caused to the company in the process of performing its duties.

What should know

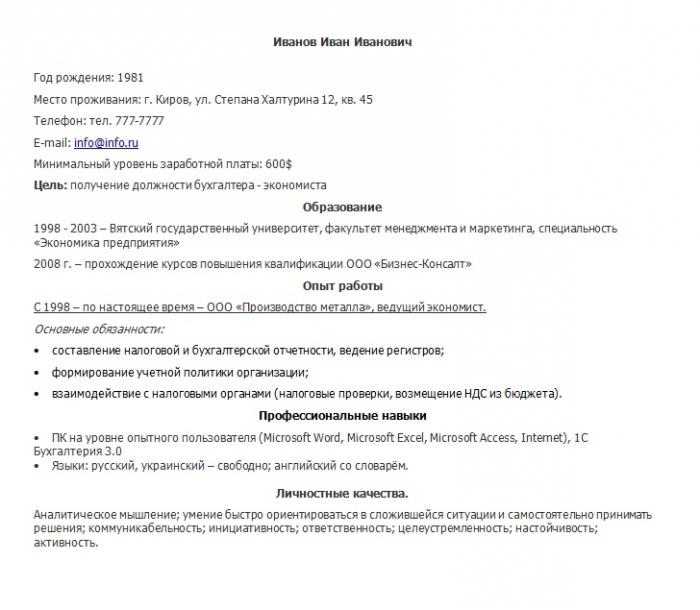

The accountant’s resume should state thatknows all the governing information, including methodological and regulatory materials relating to organizational matters, accounting and reporting on the financial activities of the company. In addition, he is obliged to know the accounting policies, accounting registers, the rules for maintaining the circulation of documents in the company. It also implies that he is aware of how the technology of processing all information relating to accounting in the organization.

В его знания также должен входить план учета capital of the company, its assets, business type transactions and liabilities. He is familiar with the labor laws and management accounting, control and reporting system. And naturally, knowledge of labor protection rules in an enterprise is important.

Qualification

For hiring an accountant’s resume shouldbe brought in that he has a specialist degree. He should have a higher education with a diploma of a specialist, and better a master's degree. Education should be the appropriate direction. It is desirable that he graduated from refresher courses.

First category

There are various categories that can getcandidate for the position of lead accountant. Qualification requirements for the first category: you must have a bachelor’s degree, master’s degree or specialist with the necessary level of training. It is also important to take advanced training courses in the relevant direction. If the candidate has a master’s degree, then he can be hired without work experience. With a specialist degree, an employee must have at least two years of experience as an accountant in the second category. Bachelors need work experience of three years.

Second category

Very rarely specialists with the second categoryhired a leading accountant. Qualification requirements for the second category: obtaining higher education and passing training courses in the relevant direction. For candidates with a specialist diploma, work experience is required only in some organizations. But for candidates with a bachelor's degree, you must have work experience in this position for at least two years.

Professional standard for the chief accountant

Chief Accountantobliged to prepare and then transfer the financial statements of the company to management and to the appropriate structures In other words, it must prepare financial statements, consolidated financial statements, taking into account IFRS, and carry out internal control over how records are kept by employees of its department. He is also responsible for planning and maintaining tax reports in the company, as well as transferring payments to the appropriate institutions.

Tax reporting should be exactlylead accountant. Profstandard implies that such a serious matter should be handled by a qualified manager, and not an ordinary employee of the enterprise. This is fully justified, because in large companies the preparation of such documentation requires special knowledge and perseverance. And any mistake or typo can result in the loss of huge sums of money or even criminal liability. If the firm has only one accountant, then when reporting for the tax it should be called the "main".

Professional Standard for Accountant

Accountant’s responsibilities include implementationthe final generalization of the managerial life of the organization. In other words, it must carry out calculations in registers, summarize and highlight balances, and also close the turnovers in the company's accounts. According to the standard, accountants are employees who are engaged in accounting and other accounting operations.