Every citizen whose age is approachingthe one where it is difficult to fulfill one's duties as an employee, claims to receive an old-age pension. During this period people are beginning to worry about the question of what pensions consist of, how the accruals are calculated and on what terms. And this is far from all the issues that future pensioners are interested in.

To whom the old-age pension is assigned

To retire, two conditions must be met:

- Experience in which a pension will be awarded.

- Age, after which a person can apply for the calculation of payments.

Types of pensions

With pension reforms these payments were divided.Now it is more difficult for citizens to understand what kinds of social security they should be appointed, and also from what pensions the old-age pension consists. There are three types of old-age benefits:

- social;

- labor;

- insurance.

A pensioner is entitled to receive any of these types of benefits. And, according to the government's idea, the labor view will gradually be replaced by insurance, so that there is no confusion.

Amount of charges

Labor pension consists of parts.There was a time when accruals were conducted according to general schemes. Now, each person is calculated individually. Therefore, it is important for future retirees to know what pensions consist of.

Under new regulations this type of payments consists of the following parts:

- Experience. It should be at least seven years in 2017, and every year will be added one year. So, by 2025 the experience should be 15 years.

- The individual calculated coefficient.

- Work experience, in the period of which contributions to the FIU were made.

- The total amount of contributions made by the employer.

According to new calculations, pensioners are assigned a payment that is proportional to the length of service and the amount of deductions to the PF.

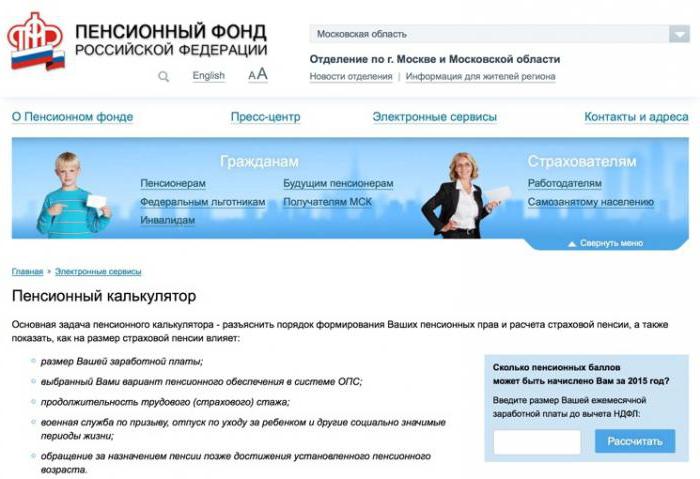

Individual ratio

Knowing from what parts the pension consists, peopleare asked about the coefficient. Since 2015, when calculating the pension, the number of points calculated according to the amount of wages and the period of work that is included in the length of service is taken into account. For mothers, the periods of care for children under the age of one and a half years will be included in the length of service. The total amount of pension points will be calculated monthly. Twice a year the points will be transferred to monetary units. This year, 1 point is equal to 78 rubles.

By 2025 the government plans to increasethe number of points to 30. And this figure will be minimal. In 2025, the pension will be accrued if the citizen has a minimum of 15 years of experience and 30 points. If the score or length of service is not enough to the minimum, then the pension will be assigned to the social, old age. This year it is almost 5,000 rubles. Since the pension can not be lower than the subsistence level, it will be charged to it, which will allow the pensioner to receive a benefit in the amount of the minimum subsistence minimum in his region.

Old-age pension

For those who meet the standards forthe calculation of old age pension will be made. And from what parts is the old-age pension? Under the new legislation, this type of benefits consists of insurance and funded parts.

Insurance is a guaranteedthe amount of payment that is assigned to each pensioner. For its purpose, it is enough to have a minimum length of service, to match age and to score the appropriate number of points. Also, the threshold of the minimum amount can be increased. This is influenced by such factors:

- age over 80 years;

- obtaining disability;

- the attainment of retirement age and the availability of dependents.

Benefits of certain categories of citizens

In a separate category, military servicemen, cosmonauts, and pilots are singled out. What are the pensions of these categories of citizens? Military benefits are calculated from the following payments:

- supplements for long service;

- payment of the title;

- payment of a post.

Know what military pensions consist of,is not enough. It is necessary to monitor all the innovations regarding the calculations. It is necessary to understand what pensions are the old-age pension. To date, military pensioners are paid the calculated part of the salary, but since 2025 the government plans to bring the pension payments of this category of citizens to the rate of 100% of the salary.

Working pensioners

Pensioners who by the time of retirementthey are still engaged in labor activity, the employees of the PF do not advise to hurry to go on a well-deserved rest. For such citizens, a system of incentives has been developed. With the voluntary refusal of early or timely retirement, the size of the future benefit increases. And not only do contributions grow, but also points. For such people there is a special system for their accrual.

For those who decide to continue working, developedlimitations. Previously, when a certain age was reached, benefits were assigned, but the citizen could continue working without losing his salary. Now he will have to choose: he continues to work and receives a salary or goes on a well-deserved rest. According to statistics, very few people make allowances, if at the last place of work he received a fairly high salary. Such people continue to work for a long time and retire only in cases of health problems.

If the citizen continues to work, then hewill be able to increase the size of his future pension by three times. But for this you have to postpone its registration for five years. In order to receive a decent allowance in old age, it is necessary to work for at least fifteen years and have at least thirty balls. In this case, the amount of monthly payments will be more than fifteen thousand rubles, but only on condition that the "transparent" salary is received, without envelopes and other unrecorded income.