To transfer funds from one account to anotherseveral details are used: card numbers, name and surname. the recipient and the sender, the name of the bank, etc. The good news is that not all of this data needs to be known for most transactions. For example, to transfer money from a card to a card within one bank, it is sufficient to specify only the plastic number. Another thing is if the transaction is carried out between credit institutions. Then it is necessary to specify the BIN. What is and where to find it, read on in this article.

Definition

Bank identification number (BIN) isthe first 9 digits of the card. It serves to determine the credit institution in the payment system, is formed on the basis of the Central Bank's standards. With the help of BIN you can find out:

- type of payment system (MPS);

- card issuing bank;

- type: credit or debit;

- type: Maestro, Electron, Classic, Gold, Standard, Platinum.

That's what a BIN is.In the process of identification, the card readers process the data from the magnetic strip and the chip. They are used to transmit information on payment details, one of which is the BIN. What is the important thing that trade institutions can learn? They receive information from cards for tracking transactions by types of payment instruments and their types, holders. This way of reading significantly speeds up the process of processing information, reduces the risk of fraudulent operations. That's what a BIN card is "Oschadbank."

Data Compliance

Information about the code can be found in publicly availablesources. But there it is updated infrequently, and often incorrect data are output. In addition, banks do not consider BIN as an important requisite. Therefore, do not track the correctness of its use. In Russia, there is not much difference between debit and credit cards. But in the US or EU countries, the percentage of the commission paid by the recipient is very different. Because some shops set strict requirements for the type of payment instrument.

Decoding of BIN

What is the first digit in the code? It means the type of payment system:

- 3 - American Express;

- 4 - Visa;

- 5 - MasterCard;

- 6 - Maestro;

- 7 - УЭК.

But this is only in theory.To identify the MasterCard, codes in the range 50-55 are used. In Australia and New Zealand since 2006, the Bankcard system operates under the numbers 5610, 56021-56022. Another example: American Express for Japan Credit Bureau has allocated codes 34, 35 and 37. Although the social card Maestro, issued by the Savings Bank of Russia, starts at 6390, and the gold Visa - from 4276.

The third and fourth digits indicate the territoryinside the state. For Russia this classification takes place according to OKATO. The card issued by the Moscow branch of the Savings Bank will contain code 45, and the institution of St. Petersburg - 40. The fifth and sixth figures inform about the conditional number of a particular unit for the Central Bank's calculations. It can range from 00 to 99. The last three numbers in the BIC are the same as in the correspondent account (it consists of twenty digits). They range from 050 to 099. For a CSC, which is carried out by the Bank of Russia, this value has the form "000". For the head settlement center - "001". For the branches of the Central Bank of Russia, the structural units of the Bank of Russia - "002". That's what a BIN payment card is.

Why all this information to an ordinary user?There is no need. In most situations. But if a person is going to pay for goods in an online store or book a service (hotel room, ticket, rent, etc.) on a foreign site, it is better to know in advance what a BIN card is and where to find it.

Option one: on the front side of the plastic

Since the BIN is part of the card number,You can learn it by looking at the payment tool. On the front side there are 15-19 digits, which are applied with the help of paint or by extrusion. This is the number. It usually contains 16 digits (4 blocks of 4 digits), 19 are used in additional payment instruments that are issued within one client account, 15 in American Express. What is a BIN card? This is the first 9 digits of the number. The rest contain information about the type, currency, region of issue, etc. Last, sixteenth, is a verification number, by which the "correctness" of the card number is determined.

Option two: contact the bank branch

Sometimes on the map are not 16 digits, but onlyfirst or last four. In this case, to find out the BIN, you need to call the hotline, dictate the full name, card number, code word. The same information will be requested when visiting the branch of the bank. But then you have to stand in line and give the passport to the employee. If you still have a piece of paper with a PIN or a contract to the card, then the code can be viewed there.

Option three: via mobile or Internet banking

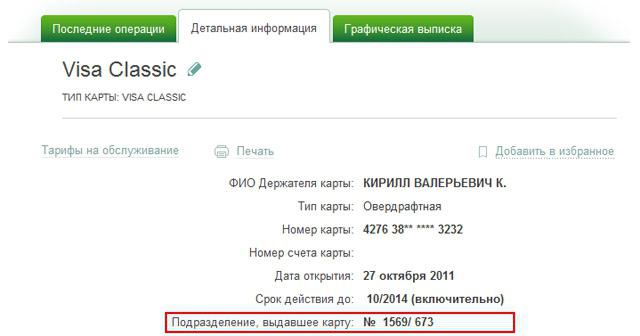

This method is suitable only for cardholdersSberbank. On the page of the "Personal Cabinet" on the institution's website, you must select the required payment instrument, go to the "Detailed Information" section. Here, the personal account and branch code (nnn / nn) will be indicated. The last information you need to copy and paste into the search box on the main page of the site. The map of the institution will be displayed with full details. So you can find out the NIC card of the recipient. But this method has its drawbacks. Internet traffic abroad through a mobile phone will not be cheap. Therefore, in order not to waste time searching for an Internet cafe, it is better to know in advance the BIC card. For example…

Through the ATM

This method is also available to holders of Sberbank cards. You need to insert plastic into the "native" ATM, enter a PIN, go to the section "My Payments" - "Requisites" and view all the card details.

In the dry residue

One of the requisites that is used fortransfer of funds between cards, is the bank number. What is a recipient's BIN card? This is a nine-digit code that identifies a credit institution that issued a plastic payment instrument. It is contained at the beginning of the card number. You do not need to perform standard operations. But if you need to pay for goods via the Internet or transfer money to the recipient in another bank, you need to know in advance the BIN number. What is important contains this code? Type of card, type of payment system, name of the issuing bank. You can find it by calling the hotline or by contacting the bank branch. It is not recommended to use publicly accessible databases, since the information in them is rarely updated.