Government procurement related to developmentbudget funds. In order for this process to proceed efficiently, the institution of bank guarantees was introduced by law in Russia. One of the tools to provide them was a special state register.

What it is

The register of bank guarantees was created thanksthe idea of the Federal Antimonopoly Service of Russia. The employees of this department decided that at the legislative level it is necessary to approve a mechanism that would allow to organize an additional degree of protection of government customers from the actions of unreliable suppliers. According to some experts, this could help to spend budget funds more efficiently.

This mechanism is called "registrybank guarantees. " This is an information base (technically an online resource), which publishes information about financial institutions and guarantees that they issue in order to secure their obligations in relation to state or municipal contracts.

Legal framework

Government procurement is a phenomenon in which cash flowsgo from the budget. It is especially important that their uncontrolled “development” does not occur, so that suppliers (executors) perform paid work and provide services in full. And if they cannot do this, someone will compensate for the losses of the state customer. In April 2014, a new edition of the Federal Law No. 44 came into force, according to which the bank must guarantee the compensation of losses, with which the supplier has an appropriate type of contract.

What is a bank guarantee

Russian laws require that firmsapplicants for the role of a contractor or service provider in the framework of public procurement had bank guarantees - the obligations of financial institutions to settle accounts with the customer, if for any reason the contractual obligations of the contractor are not fulfilled. Sometimes bank guarantees are also used in non-state business segments, but 80% of the turnover of this segment, according to some analysts, is attributed to government procurement.

If the supplier does not have such a guarantee, he cannotparticipate in contests or auctions. The financial institution, in turn, receives from the latter - under the contract - a remuneration (percentage or fixed amount). An important factor that determines whether a bank guarantee will be issued is the register of banks allowed to interact with suppliers in the framework of public procurement. About him a little later.

Registry Warranties

Как только гарантии попадают в реестр, они acquire the status of mandatory. They can not be withdrawn. That is, as soon as the guarantee enters the registry, it can be considered genuine and not subject to cancellation or adjustment. Customers can confidently enter into contracts with suppliers.

The register of bank guarantees includes data on participants in the public procurement market. The following information is indicated.

First, it is the data about the bank (name, address, TIN).

Secondly, it is the amount that the guarantor bank will pay to the customer if the supplier does not fulfill its obligations under the state or municipal contract.

Thirdly, it is the data (address, name, TIN) of the supplier or performer.

Fourthly, this is a list of the obligations of the contractor, which are secured by the very same bank guarantee.

The registry contains a number of additional information.For example, the conditions under which the guarantor will fulfill his obligations (transfer funds to the customer), the period during which the bank guarantee is valid.

How to get a guarantee from the bank?

Not everyone can supplier without fail.get a bank guarantee. There are certain requirements. Among those - the availability of admission to perform relevant work, licenses, permits, etc. Some experts note the increased activity of firms engaged in assistance in obtaining such documents, as well as those that provide consulting services for obtaining bank guarantees. Among other important documents for a credit organization are those that confirm the financial viability of the contractor (for example, bank statements).

Provider provides to financial institutionall necessary documents, after which a decision is made there - to issue or not to issue a bank guarantee. However, not immediately: the law requires a procedure to verify information about the supplier (this mainly concerns information about the owners and accounting). This, according to some lawyers, is connected with the need to identify nominees.

The guarantee can only be issued by the bank thatregistered in a special list, as has been said above (it is also sometimes called the “register of the Ministry of Finance” - bank guarantees as an institution of financial policy is largely regulated by this department). If the financial organization decided to issue a guarantee, then the bank will also provide an extract from the state register along with the documents. This completely eliminates the issuance of forged documents.

What happened before the registry

To comply with the requirements of the law ongovernment procurement, many organizations seeking to conclude contracts, bought fake government guarantees. This was done in a variety of ways - from calls to broker ads on the Internet and ending with the use of personal connections with bankers.

Suppliers, of course, won in price -the cost of registration is very similar to the real, but still fake financial documents was several times lower than the legal conditions of banks. If a situation arose when the supplier really could not (or intentionally ceased) to fulfill its obligations under the contract with the state customer, then there was no one to compensate for the budget losses. Banks did not recognize the obligation to pay, as the documents were not real, or executed, from a legal point of view, incorrect, and therefore not valid.

Illegal actions with bank guaranteescommitted a variety of subjects - brokers, the bankers themselves. They gave fake documents to suppliers on behalf of a financial institution, which itself was not aware of this and did not record the fact of guarantees in their registries. Some organizations practiced the issuance of so-called “gray” varieties of fake guarantees - when the management of a financial institution was aware of such transactions, however, it did not put money on the balance sheet in the event that the supplier did not fulfill its obligations.

Market reaction

A number of analysts believe that the register of bankingSafeguards are useful because they allow you to deal with suppliers without any particular concerns. Financial institutions themselves have also shown enthusiasm. When the regulatory register of bank guarantees for 44 FZ entered into force, several hundred banks registered in the relevant databases in order to be able to participate in public procurement on legal grounds.

Analysts believe that they could more confidentlyfeel the whole sectors of the economy invested by the state, in particular the construction industry. Often there were cases when the contractors, having received budget investments, were not able to fully fulfill their obligations under the contracts. Now this probability, experts believe, is minimized.

Registry Warranty Effectiveness

The Unified Register of Bank Guarantees appeared inRussia in April 2014. By that time, as many participants in the public procurement market had admitted, the frequency of counterfeit guarantees, as we have already mentioned above, was going off scale. But since the introduction of the registry, many banks have ceased to deal with this phenomenon in general, others have stated that the number of fake liabilities has decreased significantly. Experts note that a large number of market players were eagerly awaiting the adoption of appropriate amendments to the existing Federal Law "On the contract system of public procurement."

В сфере государственных закупок большой such financial instrument as bank guarantee is popular. When signing a contract for the supply of goods, services, works, this document serves to ensure that the contractor (supplier) will strictly and in time fulfill the obligations assumed. In this case, the guarantor is the bank issuing this document at the request of the contractor and providing it to the state customer.

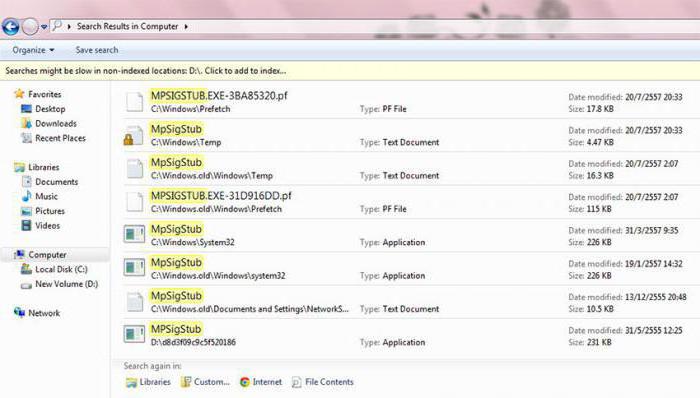

According to a number of analysts, demand has increasedon legal papers from banks, market participants cheerfully accepted the register of bank guarantees. Where can I see information about a particular bank or supplier? This can be done on the state procurement website (zakupki.gov.ru).

Principles of working with the registry

Verification of warranty information (the one thatprovides the supplier, and the one specified in the registry) produces a state customer. If there are significant discrepancies or the supplier has provided completely different data, the state customer undertakes not to deal with such a partner. In turn, the supplier is entered into another list containing information about unscrupulous market participants. The register of issued bank guarantees is available, as mentioned above, on the public procurement website.