Russia, like other countries, is tryingstrongly support their citizens. For example, here you can arrange the so-called tax deduction. It is provided for certain expenses. Today we will be interested in tax deduction documents for tuition. In addition, it is necessary to understand when a citizen can demand this or that money from the state. What about tuition fees you need to know? How to make it? What documents may be useful in one case or another?

Where to go

The first step is to understand where to go.for the realization of ideas in life. In 2016, tax legislation changed a little in Russia. Now, by law, you can arrange a variety of social deductions (for treatment and study) right at work. What does it mean?

From now on, documents for tax deduction for tuition are taken:

- in tax authorities;

- at the employer;

- through the MFC (in some regions).

Most often there is the first scenario. However, the list of documents attached with the application does not change. He always remains the same.

Deduction for training is ...

And what is the tax deduction for tuition?If a person paid for educational services, he is entitled to reimbursement of 13% of the costs incurred. This possibility is spelled out in the Tax Code of the Russian Federation, in Article 219. The return of the money spent on studies is called the tax deduction for tuition.

Deduction is part of non-taxable income.by taxes. In other words, in Russia it is allowed to return the tax on tuition fees. Accordingly, 13% of the cost of training for themselves and children can be returned if there is income subject to personal income tax.

For whom you can get

Under what conditions can you apply for a tax deduction for training in a particular organization?

To date, it is allowed to reimburse expenses incurred for study:

- yourself;

- children;

- brothers and sisters.

At the same time have to abide by a huge amountconditions The recipient can only be the one who paid the money for their studies. As already mentioned, a citizen must have official work and income taxed at 13%.

When make out a deduction for yourself

As a rule, there are no restrictions on the provision of deductions for own training. This is the most simple scenario. Among the main requirements in this case are:

- The presence of official income. At the same time, it should be taxed at 13%. Thus, an entrepreneur working with the simplified taxation system or a patent cannot return the tuition fees.

- There was a payment of educational services in official institutions. For example, studying in high school or driving school. Courses and trainings as training are not considered.

Perhaps that's all.If these conditions are met, you can collect documents for tax deduction for tuition. A distinctive feature of receiving money for their own studies is that the form of education does not matter. A person can learn, both on full-time and part-time, evening or any other department.

Self deduction

How much money is allowed to return for your own study? By law, you can count on 13% of the costs incurred. But at the same time in Russia there are some restrictions.

Which ones? Among them are the following features:

- Return more tax paid will not work. Only income tax is taken into account.

- The maximum amount of deduction for tuition is 120 thousand rubles. In this case, you can return no more than 15,600 rubles in a given year. This restriction is due to deduction limits.

- The current restriction applies to all social deductions. This means that for education, treatment, and so on, a total of 15,600 rubles can be demanded per year.

In fact, everything is not as difficult as it seems. What tax deduction documents will be required in this case?

Getting a deduction for yourself

The list of papers is not too extensive. However, this scenario implies the least paperwork.

Among the documents necessary for the implementation of the task, there are:

- the identity of the applicant (best of all, that it was a passport);

- contract for the provision of services with an educational institution;

- certificate of income (form 2-NDFL, taken from the employer);

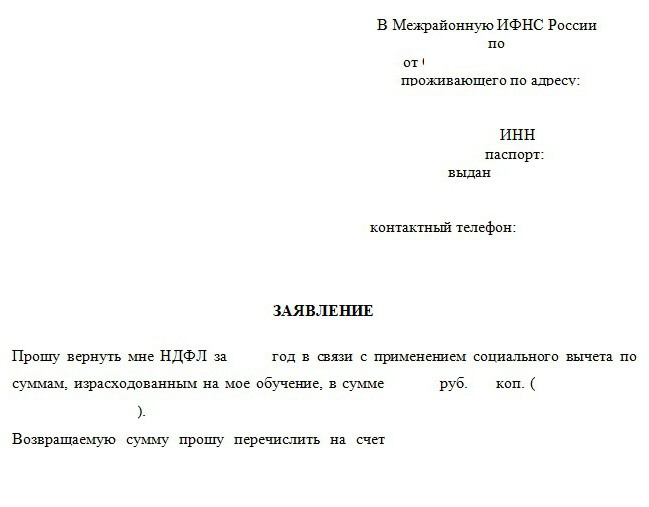

- application for the deduction;

- educational institution license (certified copy);

- 3-NDFL tax return;

- payment orders indicating the fact of payment for educational services;

- details for the transfer of money (indicated in the statement).

In addition, if you need a tax deduction fortraining in high school, documents are supplemented by the accreditation of the specialty. All listed papers are served with certified copies. Checks and cash orders indicating the fact of payment of training, give the tax authorities only in the form of copies.

Conditions for deducting children

And when and how can I get a tax deduction for teaching children? For this, too, will need to follow a number of rules. Which ones?

To apply for a child’s tax deduction, you must meet these criteria:

- children less than 24 years old;

- children learn full-time;

- payment of educational services is made by the parent;

- The contract with the institution was signed with the legal representative (mom or dad) of the child.

It is important to remember that for one child you can get back no more than 50 000 rubles. For the year the amount is 6 500 rubles. No further restrictions are required by law.

Documents for the deduction for children

To reimburse the expenses for the child's studies, it is necessary to prepare a certain package of papers. They need more than the previously proposed list.

Documents for the child's tax deduction include the already known list of papers. In addition, it is supplemented by:

- child's birth certificate (copy);

- student certificate (taken in an educational institution);

- a copy of the marriage certificate (if the contract is concluded with one parent, and the deduction is made on the other).

That's all.In addition, tax authorities may request a copy of a child’s identity card over 14 years of age. This is normal and should not be scared. There is no need to verify a copy of your passport.

Conditions for obtaining a deduction for brothers and sisters

As noted earlier, a citizen mayreturn some of the money spent on training a brother or sister. This is a rather rare but practical phenomenon. The list of documents for the tax deduction for tuition will be supplemented with several more papers. But more about that later. First you have to find out when a citizen has the right to reimbursement of expenses for the education of a brother or sister.

Conditions for obtaining a deduction for study in this case will be as follows:

- sister or brother is not 24 years old;

- a person is studying full-time;

- the contract is concluded with a claimant for deduction;

- all bills and receipts indicate that it was the applicant who paid for the training services.

What restrictions will apply to reimbursement? Exactly the same as in the case of deduction for the education of children.

Documents for deduction for studying brothers

And what papers will be required in this case? How is the tax deduction for tuition? What documents are needed when it comes to getting an education by a brother or sister?

The previously listed list of securities (for yourself) is supplemented by the following components:

- own birth certificate (copy);

- birth certificate of the person for whose training the applicant paid;

- student reference (original).

Nothing more is needed.In exceptional cases, you will have to submit any documents indicating the relationship with the student / student. But this is an extremely rare occurrence. The birth certificates to the tax authorities are sufficient.

Return period

The documents required for a tax deduction for training in one way or another are now known. A complete list of them was presented to your attention. But there are still unresolved important issues.

For example, for what period is allowed in Russiamake out deductions. How much is the limitation period of treatment? How much time are tax deductions for tuition reimbursed? What documents to bring with you is already known. But it is important to remember that the application is allowed to submit no later than 3 years from the time of one or other expenses.

This means that the limitation period for handlingcorresponding request is 36 months. In this case, the right to receive a deduction appears only in the year following the one in which the payment for services occurred. If a person paid for his studies in 2015, it is allowed to demand a refund only in 2016.

Кроме того, необходимо помнить, что обращаться за money can be up to the full consumption of the established limit. As long as a citizen has not exhausted a social deduction for education equal to 120,000 rubles, he is able to demand money from the state at the corresponding expenses.

Can refuse

Can the tax authorities refuse this payment? Full Sometimes the population is faced with situations in which a failure comes in response to a request. This is normal.

What to do if you are not able to issue taxtuition deductions? What documents and where to carry? In this case, it is recommended to investigate the reason for refusal to refund the funds. Tax authorities are required to justify their position. The most common failure is associated with the provision of an incomplete list of documents. In this case, within one month from the day of receiving the alert, the situation should be corrected. In this case, re-apply for deduction of tuition is not necessary.

If the problem is not related to the documents, you needeliminate inconsistencies requirements for processing deductions and resubmit the application for consideration. Under certain circumstances, the return of the money will not work. For example, if the statute of limitations has passed.

Results and conclusions

From now on, it is clear which tax documentsDeductions for tuition are provided in one way or another. As already mentioned, all listed papers are attached with copies notarized by a notary. Only then can we speak with confidence about the authenticity of the papers.

In fact, return the tuition fee is not sodifficult. It is recommended to contact the tax authorities annually. Some prefer to demand a deduction immediately after 3 years of study. This is also possible. It is allowed to submit an application for consideration at any time from the moment the right to a deduction arises.

Сколько времени уходит на оформление операции?Usually getting a deduction takes 3-4 months. Moreover, most of the time you have to wait for a response from the tax authorities. Verification of documents is carried out carefully, and therefore have a long wait. What is the list of documents for tax deduction for tuition? This is no longer a mystery.