Сегодня сотрудники HR-отделов многих компаний все more often rely on such a reception as bonuses. This allows you to significantly increase the attractiveness of the enterprise for applicants and employees, and therefore makes it competitive. Another huge plus of bonuses is that interested employees work more willingly.

The essence of the premium system

According to the definition given by the Labor Code,bonuses are the accrual and payment of additional financial resources to employees of the enterprise in addition to wages. Such a scheme is available to absolutely all organizations, regardless of the form of ownership and type of activity.

Bonus system at budget enterprisesdetermined directly by their management. In this case, the type of material incentives, and its size can be appointed by the head of the organization. The main condition: the total amount of payments to employees (salaries plus bonuses) must be within the allocated allocations.

For non-budget companies the situation is a bitsimpler. Since they are not entitled to financing, they don’t have to report on how much money was spent on wages. For this reason, such enterprises have relative freedom of action. At the state level, the minimum wage threshold is defined, and on its basis, the firm’s management sets salaries, bonuses, allowances and bonuses.

Types of bonuses: regular payment features

Two types of premium are most commonly used.payments. The first of these is the remuneration that is provided for in the firm’s wages. Bonuses in this case are systematic, that is, the premiums are paid regularly (once a year, quarter, half year, month, week). Not all employees are awarded, but some specific circle, for example, economists, sales staff, or employees of several departments. To derive the amount of the premium, take into account the specific labor indicators developed by the company and the conditions for bonuses.

In addition, there is a fixed amount of payments: one official salary, its half or a percentage of the amount of wages.

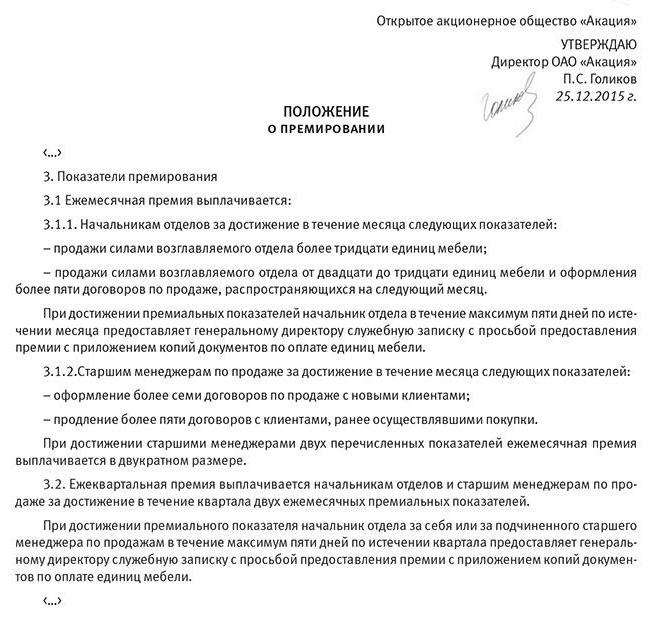

All the nuances that accompany the processaccruals and payments of financial remuneration of the first type, contains a provision on employee benefits. This document is approved by the administration and, if necessary, it is coordinated with the trade union. The provision imposes on the organization the obligation to give employees a bonus in a specific amount if they fulfill the stipulated conditions.

Read more about premiums of the first type.

On a closer look, financial rewards of the type described are divided into two groups:

- The reward for having achieved the planned goals of the company. Such bonuses are a major incentive for staff who encourage them to complete tasks.

- Encouraging initiatives - reward for the improvement of equipment, accounting systems or other aspects of the organization.

This type of bonuses is combined into a special group and used when an employee has achieved savings in raw materials, some kind of energy or helped his company in another way.

One-time bonus is not a system

As the name implies, lump sumfinancial rewards are not paid regularly. The main condition for obtaining them is to achieve specific success in work or the onset of a significant event, for example, a public holiday, the anniversary of the company, industry, a particular employee.

Образец премирования работников в таком случае Next: An employee has worked in good faith for the benefit of the company for ten years In honor of such an anniversary, the head issues a decree on awarding the prize to the distinguished one. That is, the basis for the payment of remuneration becomes a memorable date (this and other similar conditions contains a provision on employee bonuses).

Why make up a position

This document can be attributed to local acts.organizations, that is, its structure and content, each company develops independently. The document is valid only for employees of a particular company.

A sample of the remuneration of workers is presented below.

When compiling it, the administration pays special attention to the economic justification of bonus payments. Their main task is to avoid the egalitarian principle in the distribution of rewards.

Исходя из специфики технологического процесса, production cycle and periods used for accounting, choose the time for bonuses. These same factors determine whether a site, workshop, division, or the entire company will be rewarded.

Additional payments and surcharges, which are taken into account when charging premiums

Заработная плата некоторых сотрудников enterprises may not consist of only one salary. Sometimes people take on additional responsibilities and responsibilities, which, of course, is reflected in the financial plan. For others, higher wages are due to difficult labor conditions or professional accomplishments.

If the accountant is engaged in the calculation of regularrewards, it makes sense for him to keep the sample of the remuneration of workers once created as a template. When a company has more than one category of workers, who have different types of financial payments, there should be several templates prepared.

An extra charge may be added to the employee’s wage rate if he:

- Combines profession (position).

- Performs duties of another employee (who is temporarily absent).

- Working in adverse conditions.

- Works at night.

- It has an irregular working day.

- Reached a high professional level (received a class or an academic degree, noted for high achievements, fulfilled important assignments).

A more accurate list of additional payments is compiled for each company individually.

The organization of bonuses: the conditions under which the remuneration is due

In order for the awards issued to become a motivating factor for employees, they are distributed, accrued and issued in accordance with the system developed in advance.

There is nothing worse than unfair punishment or unreasonable encouragement, because in this case the authority of the manager is undermined, and you can no longer count on the trust of employees.

The conditions and indicators on the basis of which premiums are charged are set forth in the provision on bonuses (the sample proposed above is just one of the possible options).

How to create a premium system

System developers take into account the following factors:

- Have goals been achieved and do they affect labor efficiency?

- Whether the indicators for which the bonus will be awarded.

- Whether conditions are created under which you can make bonuses.

For employees of various services and departmentsthe same enterprise indicators bonuses, goals and conditions will be different. For example, technical control officers can be awarded only when specific product quality indicators are achieved. For designers and technologists, remuneration is often appointed for the fact that they develop and introduce new equipment, technologies and materials. Accountants earn bonuses by compiling certain reports and performing calculations.

In the case when the result of the work can beestimated using objective indicators (quality, quantity, volume), the amount of remuneration is tied to such data. If the content of the work and its results are more abstract (scientific achievements, research, other creative tasks), then the amount of payments depends on the personal contribution of a specialist to the common cause or is determined by expert judgment.

What employees of the company are given awards

Bonus payments rely only on thoseemployees who are on the company's staff, as well as people who work under a fixed-term employment contract (hired for a specific task). In the case when an employer signs a civil law contract with a person, the section on monetary remuneration is negotiated separately.

For non-staff employeesother conditions apply: the administration may include an item on bonuses in a collective agreement or discusses the need for additional payments with a trade union representative, the chairman of the council of the labor collective or with another authorized person.

How does the presentation on bonuses

When the next period comes to an end (month, quarter, year) or a specific task is completed, accounting staff and department heads proceed to the distribution of bonuses.

First of all, accountants prepare statements of expenditures for this period, the wage fund and how much money will be spent on financial motivation of employees.

Next, the director examines the reporting data obtained from the divisions (in the case when they are available), and distributes funds between departments.

The job of deputy heads is tothat they supervise the units entrusted to them (branches, departments, laboratories). At the end of the bonus period, they must make proposals regarding the amount of incentives for the heads of these structural units. At the same time, deputy directors listen to the opinion of their subordinates (heads of departments) on which award should be given to specific employees. Most companies choose to submit proposals in writing.

Completion of the submission procedure

At the next stage, all submitted proposals must be coordinated. In conclusion, they are approved by the director of the enterprise, and this becomes the basis for the relevant order.

The administrations of some companies also prefer to coordinate their actions related to the financial incentives of employees with representatives of the workforce or trade union.

When all conditions are met, the manager mayissue an order on the organization, which will present the grounds for the issuance of awards and its size for each employee. Regardless of whether a premium position is accepted in a company, an order is issued anyway.

Separate nuances

If they reward employees of a large company, thenThe order does not indicate a list of all names. They are part of a separate document that prepares the department of work with personnel. This list is considered an attachment to the order.

All financial rewards requiredreflected on the personal account of each employee, and also appear in his payroll. This is necessary in order to be able to derive the average wage with maximum accuracy.