Often the organizational form of legal entity Ltd.chosen by several entrepreneurs who plan to work together in a specific activity. Under these conditions, each co-founder has its own share in the company. If a participant’s withdrawal from an LLC is required, you should know how this process is carried out, to whom the share is transferred, how this procedure is correctly drawn up.

Legislative regulation

In Art.94 of the Civil Code stipulates the right of each member LLC to withdraw from this company. Additionally, you should study the information from the Federal Law “On the LLC” describing the process of organizing and liquidating the company. In the same document, the rules of the LLC and the possibility of the founder of the company.

In numerous regulations of the Federal Tax Service alsothere is a lot of information. For example, you can find in them the rules for forming the application form, on the basis of which changes are made to the Unified Register of Companies on the number of participants in the company.

When a procedure is required

The participant’s withdrawal from the LLC may be required in three situations:

- The citizen is dying.

- A person voluntarily decides that he needs to leave his post for various reasons.

- Forced dismissal.

Each option has its own characteristics.

Member death

If a citizen dies, then the legal heirsare entitled to receive his share. The process should be carried out within six months. If during this time the heirs are not detected, claiming their rights, the shares are distributed among the other participants of the LLC

Наиболее часто претенденты на долю перечисляются in the will, but if there is no this document, then the legal heirs are taken into account. First of all, these include the closest relatives, among whom are parents, children and spouses. The person who received the share is a new member of the society, therefore the same rights that the deceased person had are granted.

Voluntary exit

For various reasons, citizens may need to stop working in society. Voluntary withdrawal of the participant from the LLC takes into account some points:

- For this, a special application is compiled.

- The document is notarized.

- The share is sold either to the other founders or to third parties, but in the latter case such an opportunity should be provided for by the Charter.

- The citizen himself must search for the buyer.

- The cost of the share depends on the financial situation in the company.

- All additional issues that arise during the exit of a citizen from the company are decided at a meeting of the founders.

- The director of the LLC must transfer the necessary information to the FTS so that changes can be made to the Unified State Register of Legal Entities.

The withdrawal of the company from the participant LLCreceipt by the citizen of payment equal to the price of his share. For calculation, accounting data for the previous year is used. Funds are transferred within 90 days after the procedure.

Enforced exception

Выход из состава участников ООО может быть forced. Under these conditions, the process is made only through the courts. Only other founders of the company, who have a share exceeding 10%, can file a claim.

The founders are most often excluded for reasons:

- Not satisfied with the activities of the citizen in the company, which usually leads to negative consequences. A cleaned person shies away from solving the problems of the enterprise.

- The conditions of the legislation are violated, therefore, the duties of a citizen are not properly fulfilled.

- The seizure of property by the citizen.

- Conducting illegal transactions or meetings.

- The conclusion of contracts that lead to negative consequences for the entire organization.

The court must make sure that the plaintiff doesThere are strong arguments to exclude a participant from an LLC. If there is evidence, this process is performed. A citizen who leaves the company must pay legal fees.

Exit procedure

The most common voluntary exitfrom the list of participants LLC. This process should be provided for by the articles of association. It prescribes the procedure for implementing this procedure and the rules for amending the constituent documents.

If there is no necessary information in the Charter, then theypreviously made, but all co-owners of the LLC must agree to this. It is necessary to understand how the participant’s exit from the LLC is implemented. Step-by-step instruction of this process is to perform the following actions:

- Initially, all members of the public are notified that a specific participant plans to leave the company. For this, he makes the correct statement.

- A meeting is held at which all issues are discussed and a decision is made, and all information is recorded.

- Submitted to the FTS application for changes in the composition of the company.

- Changes are made to the register.

- Calculations are made with the outgoing co-owner.

Each stage has its own nuances, so you should understand the rules of the whole process.

Drafting an application

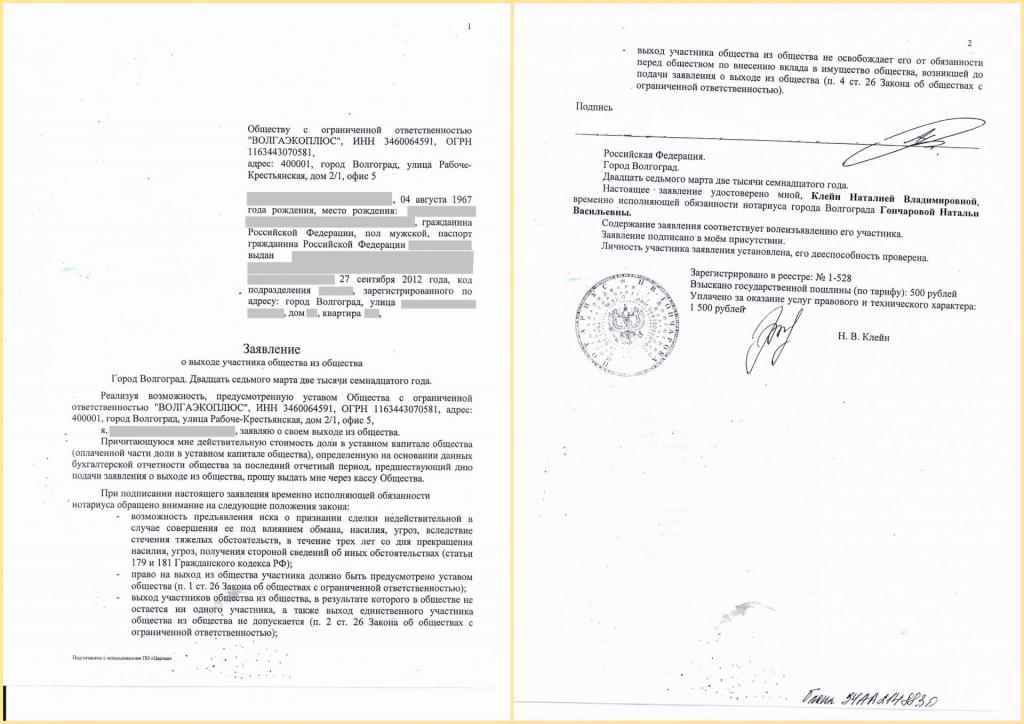

Every person who wants to stop working in a company must correctly prepare a statement of withdrawal from the participants of the LLC. A sample of this document is located below.

Drawing up this application is the first step of a citizen to leave the company. The document is sent to the executive body of the company, represented by the general director.

There is no established form of application for withdrawal of participants from the LLC. The sample is desirable to use to take into account all the important nuances. Certainly it contains data:

- Information about the citizen himself who plans to leave the company, namely, full name, passport details and place of residence.

- Information about the enterprise.

- The size of the share owned by the applicant in the LLC.

- The date when the application was written and transmitted.

- Citizen Signature.

Based on this document, the participant withdraws from the LLC. The sample is considered simple and understandable, so everyone can make a statement.

Holding a meeting

As soon as the head of the company receivesstatement, he must find out whether the possibility of withdrawal from the LLC Charter. If there is no necessary information, then you first need to enter such information, register it, and then begin the procedure.

Based on the application, a meeting of the founders of the enterprise is held. This meeting addresses various issues:

- The decision is made to withdraw the participant from the LLC.

- It is decided where the share will be directed, as itmay be distributed among other participants, sold to one of the founders, transferred to third parties or left under the authority of the company until the end of the year.

- Set the optimal value of the share.

- It is decided in what time the funds will be paid to the participant who has left the company.

All decisions made are necessarily recorded in the protocol of the participant’s withdrawal from the LLC. It must be maintained, as it will be required when preparing documents to the FTS.

How is a share value determined?

To calculate the amount that will be assigned to the founder who has left the company, it is necessary to multiply the existing share of the company's net assets.

When calculating the share payment to the participant LLC upon exitIt takes into account the value of assets, which is indicated in the balance sheet for the previous year. Funds must be transferred within 90 days after the official registration of the co-owner. It is allowed to use not the funds, but the property for payment, if the output of the participant LLC is carried out The payment in any case should correspond to the size of the share of the citizen in the company.

Provision of this amount is not allowed if there has been a loss in the past year as a result of the work of the company.

Transfer of documents to the FTS

The next stage of the process assumes that the necessary documents are transferred to the office of the Federal Tax Service in which the company is registered. Based on these securities, changes are made to the Unified State Register of Legal Entities.

For this purpose, an application is made in the form Р14001.A properly filled out document is sent to the FTS within a month after the general director receives an application from the participant. The following papers are attached to it:

- Articles of association.

- Certificate of Incorporation.

- Copy of OGRN.

- Minutes of the meeting.

All documents are pre-notarized. After examining and fixing these papers, the FTS issues a new extract from the Unified State Register of Companies, which will contain information about all the participants in the company.

What to do with share

Often, the participant’s withdrawal from the LLC is required.The step-by-step instruction of this process is considered to be fairly simple, but at the same time the management of the company decides where the share of the released founder goes. There are several ways to do this.

| Share method | The nuances of the process |

| Distribution of shares among the other founders | This option is considered the most common. The distribution is implemented in proportion to the shares of all participants. It will not work with this method to equalize the capital of the founders. |

| Sale of shares to participants | Покупателем может выступать один гражданин или several founders. In this case, the contract of sale. Since under such conditions the proportions of citizens change, then a corresponding decision should be made at the meeting of participants. |

| Sale to a third party | Если используется этот метод, то предварительно it is necessary to make sure that the Charter does not prohibit this procedure. For the transaction used a standard contract. Decision made at a meeting of participants. You do not need to notarize such a contract, but registration is required, after which the agreement enters into force. |

The decision must be made within one year, otherwise the transferred share is redeemed, and the share capital is reduced.

How can the sole founder leave the company

Often an LLC is opened by one person, and whensuch a situation is not allowed his exit from the company. Therefore, under such conditions only liquidation of the company can be carried out. The decision to start this procedure is made by the founder.

The process by which the proportion of the solethe founder is alienated to a third party, is allowed only after the new co-owner is included in the participants. Next, changes are made to the Unified State Register of Legal Entities, and only then can a share be transferred to it. Therefore, initially a new manager must deposit his capital in order to become a member of the enterprise.

How is the process of accounting recorded

The procedure must be properly documented by the enterprise itself. When a participant leaves the company, the accounting department conducts actions:

- The nominal price of a citizen’s share is calculated.

- Determined by the actual value, which takes into account the value of the net assets of the company and the share of the departed participant.

- The amount may be provided in cash or valuables.

- Выплата отражается разными проводками:D81 K75 - the nominal share price, D84 K75 - the difference between the nominal and actual price, D75 K50 - the amount paid to the former participant, D75 K68 - the amount of taxes on income received, D75 K81 - the amount transferred to another shareholder with the simultaneous formation of a sub-account.

The real share price is calculated based on the CU.Often, former participants file a lawsuit in court, since they want the amount to be given to them to be close to the market value. In such a situation, the firms themselves should avoid litigation, so the meeting may decide that the payment is assigned as a result of a share assessment.

Nuances and pitfalls

Participant’s withdrawal from LLC is sufficientspecific process that leads to significant changes in the work of the enterprise. Therefore, you should understand the main features and nuances of its implementation. These include the following:

- Until the moment when a person will filean application for withdrawal, the duty to make contributions to the LLC remains with him, and if this is not done in a timely manner, the submission of the application will not be grounds for exemption from this procedure.

- The consent of all founders to exit is not required.

- The application can not be withdrawn or canceled.

- Payment is possible only with the consent of the member who left the firm.

- The amount received is considered to be the income of a physical person, therefore it must be stated in the 3-NDFL declaration in order to calculate tax from it.

- The firm must, on the basis of its contracts with counterparties and banks, notify them of the changes made to the register.

Although the participant’s withdrawal from the firm is considered difficult,If you carefully study this procedure and correctly perform sequential actions, then there will be no problems. It is important to notify the FTS about the changes that have occurred. The share can be transferred both to other founders and to third parties. When implementing the process, it is necessary to take into account the requirements of the Federal Law “On the LLC”. The accounting department of the company must correctly execute this procedure. The process itself depends on whether the participant leaves the company voluntarily or by force.