Наверное, мало кого оставляют равнодушным information about the change in the rate of the Russian currency. The reasons for the ups and downs of the ruble are the subject of the hottest debates. Meanwhile, over the past five years, the national monetary unit has given the Russians more than a dozen surprises. Among a number of domestic economists there is a perception that what is happening with the ruble is a direct consequence of the events of 2008. In part, it is true, but the current dynamics of the national currency is much more dependent on the current state of our finances and the current political situation.

Ever-memorable 2008

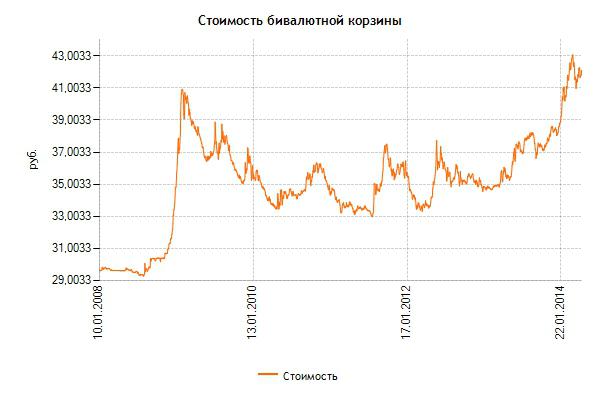

Almost everyone has an opinion aboutthe causes and consequences of a serious global crisis. In principle, today it is not so important whether it was provoked by the players of the international financial market or was the result of a global conspiracy. Much more interesting is what turned these events for the domestic financial system. Here are a few figures that illustrate the consequences of the crisis for Russia:

- Within one year, 54 credit institutions were liquidated in the country, and 47 of them were deprived of banking licenses.

- The dollar rose from 23.4186 rubles. On August 1, 2008 to 29.3804 rubles. on December 31, 2008 (by 25.4% for 5 months); by August 1, 2009, the dollar was already worth 31.15 rubles. (33.1% - growth rate for 1 year).

These figures clearly show the blow that was struck to Russian finances as a result of the 2008 crisis. Our citizens could recover from it only after a few years.

2009-2011

During this period, the Russian economy graduallyrecovered, and the financial market sought to return to previous positions. Despite the achieved stabilization of the ruble exchange rate and the growth in production that has emerged in certain industries, the ruble will continue to gradually become cheaper.

Of course, this process was not linear,but in general, the trend was quite obvious: at the beginning of 2010, the dollar was worth 30.1851 rubles, in 2011 - 30.3505 rubles, in 2012 - 32.1961 rubles. Thus, for 3 years the ruble fell by 6.68%. Everyone recognized this dynamics as quite acceptable: the Government of the Russian Federation and the population of the country. The question of what is happening with the ruble exchange rate, worried the Russians in this period rather weakly. As a result, the interest of Russian citizens in the acquisition of foreign currency in cash, as well as in maintaining it in the form of bank deposits, has decreased.

year 2012

Unfortunately, all good things everIt ends: by May 2012, the ruble began to decline in relation to the leading world currencies. Thanks to the massive currency intervention of the Central Bank, as well as its repeated assurances about the stability of domestic finances, the fall in the exchange rate was then stopped. However, the dollar still went up by almost 2 rubles, and the euro - by 2.5.

Russians are again interested in the question ofwhat happens to the ruble. Today, leading domestic economists and political analysts are inclined to explain the then fall in the exchange rate of the national currency by the traditional reasons for our country:

- lower oil prices;

- problems of the European economy;

- investors' concerns about the new wave of financial crisis.

At that time, the sharp reduction in the cost of the ruble inThe press was treated as a necessary exchange rate dynamics, designed to revive the country's economy and not allow it to fall into stagnation. Who exactly was right is not easy to say. However, regardless of the real reasons for the depreciation of national money, the population panicked buying cash dollars and euros, and investors rushed to urgently save their assets. Despite the continued export of capital from the country, the regulator managed to stabilize the ruble exchange rate and keep it within the borders of the dual currency basket: at the end of December 2012, the dollar was worth 30.3727 rubles, and the euro was 40.2286 rubles.

year 2013

Throughout 2013, continued smoothdepreciation of our currency. Seeing the extremely negative reaction of the population to what is happening with the Russian ruble, the Central Bank once again resorted to buying it on a large scale to maintain the exchange rate. Approximately $ 28 billion was spent on these good goals, but the rate of the national currency to the dual-currency basket for the year fell by almost 3 rubles.

Obviously, this year was not the most successful forruble. However, optimists seriously predicted that the holding of the Sochi Olympics contributes to the stabilization of the course, by increasing the flow of additional currency into the country from sports tourists. By the end of the year, even people who were not aware of any particular financial problems were seriously worried, looking at what was happening with the ruble. 2014, however, the majority of Russians met with the hope of stabilizing the course of our money, improving the state of the banking system and the imminent revival of the country's economy.

year 2014

The year began with not the most joyous for the Russianthe ruble of events: already on January 15, the Central Bank shifted the boundaries of the floating currency band up by 5 kopecks. In January, such actions were repeated 6 times, and by the end of the month the dual-currency basket was already worth 41.0284 rubles. In February, this trend persisted, and on 26.02.2014, the historical exchange rate maximum was again updated. Then the value of the dual currency basket reached a threshold of 41.9952 rubles. For 2 months of this year, about $ 12 billion was spent on stabilizing the rate of the domestic currency, which made it possible to bring it into a certain equilibrium state.

Sport as a stabilization factor

The holding of the Olympics has partially slowed down.cheapening of the ruble. Positive news events, a decrease in the degree of tension among Russians, as well as an increased inflow of foreign currency into the country allowed the regulator to keep the Russian currency at an acceptable level without additional interventions. Moreover, in April, the ruble bravely tried to win back its positions. By the May Day holidays, the dual currency basket had already cost 41.8409 rubles. Thus, for 4 months of the current year, the value of the dual currency basket increased by 9.4%.

According to the forecast of the information section editorof Ivan Vasilyev’s Forbes magazine, given to them at the beginning of January, for 2014 the ruble exchange rate to the dual currency basket will fall by about 7.5 rubles. (or 20%). While maintaining the existing ratio in the dollar / euro pair, the ruble exchange rate against both currencies will fall by the same 20%.

Factors Influencing Course Dynamics

What is happening now with the ruble was noteven in the darkest predictions. Leading analysts are urgently reviewing the calculations of the value of the national currency, made by them at the end of last year. However, there are factors that directly affect the ruble exchange rate, but are not amenable to digital evaluation.

Продолжающиеся события на юго-востоке Украины, the negative attitude of some European and American politicians to the position taken by Russia on this issue makes the introduction of various sanctions against our country quite probable. Since the domestic economy is already quite deeply integrated into the world economy, this can significantly shake the stability of the Russian banking system and lower the exchange rate of the domestic currency. What happens to the ruble is quite understandable - it is gradually getting cheaper. Practically no one can predict what will happen to his course tomorrow.

Western look at the Russian currency

Главными нашими проблемами, по мнению IMF specialists today are tense geopolitical situation, the possibility of imposing tough sanctions from Western financial institutions, accelerating inflation, the budget deficit. It is declared that the Russian economy has smoothly crept into recession, therefore, the forecasts of most foreign experts about the prospects for our currency are sad. After the S & P rating agency lowered Russia's sovereign credit rating to BBB-, it became obvious to all that a further devaluation of the ruble was not only possible, but inevitable.

Long-term forecasts from Russian financial gurus

Today, almost none of the officialsour country can not clearly explain to citizens what is happening with the ruble. The forecasts of most experts regarding the coming months of 2014 boil down to the fact that the ruble will continue its traditional decline. As a matter of fact, the main discussions are conducted only about its pace. It is obvious that it is not possible to keep the ruble exchange rate within the framework provided by the 3-year budget (2014 - 33.40 rubles, 2015 - 34.30 rubles, and 2016 - 34.90 rubles). the end of April 2014, the dollar was already worth 35.70 rubles. And in early March, the dollar has already managed to take the bar at 36 rubles, and the euro has broken through the historical maximum of 50 rubles.

The head of the Central Bank Elvira Nabiullina confirmed April 25.2014, in an interview with Ren-TV, that the regulator does not intend to carry out large-scale interventions in the foreign exchange market. What is happening with the ruble now, the Central Bank calls the necessary correction. Most likely, the transition to a floating exchange rate of the ruble will be made not by the beginning of 2015, as it was declared earlier, but in the summer of 2014.