Economics is filled with beautiful butin obscure terms — inflation, devaluation, denomination. Nevertheless, to understand the essence of all these concepts is not as difficult as it seems. And for this it is not necessary to have a specialized economic education. In this article we will introduce the reader to the devaluation, its main types and causes. What is behind this term? And how dangerous is devaluation for the national economy?

Devaluation is ... Meaning

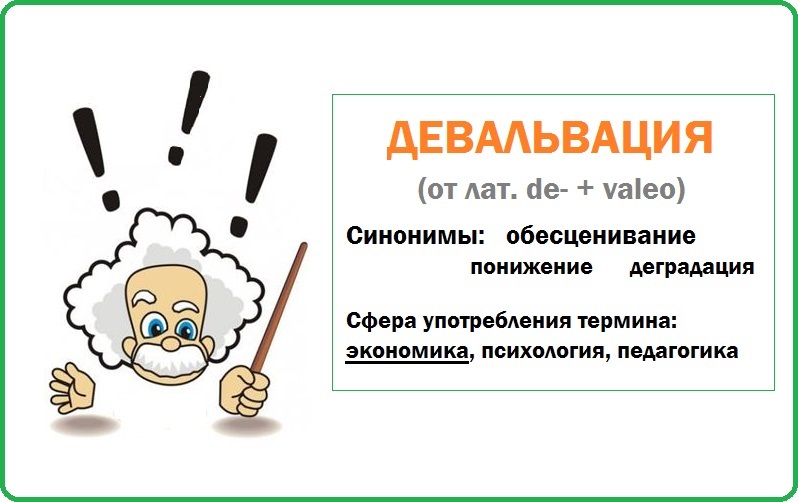

Слово «девальвация» пришло в русский язык из Latin It is derived from the Latin verb valeo (“cost”, “have value”) and the prefix de-, which means a reduction of something. The main synonym is "depreciation". Antonym - "revaluation" (about this term, we also talk in our article).

Devaluation is widely used ineconomic theory term. However, it can be found in some other scientific disciplines. For example, in psychology and pedagogy, where it is used as a category of "devaluation of the individual." In this case, the degradation of the main characteristics of the human social nature (primarily spiritual and moral) is implied.

In addition, the term is also used inliterary speech. Often in books and popular science articles one can find the following figurative phrases: “devaluation of the word”, “devaluation of the meaning”, etc.

What is devaluation (in economy)?

In the early 2000s, for one American dollar you needIt was laid out 30 Russian rubles, today - twice as much. Nominally, a thousand rubles and a thousand euros are one and the same. But in reality between them is the deepest abyss.

So, what is the essence of economicdevaluation? The definition of the term is quite simple. This is the official depreciation of the domestic currency against more reliable foreign currencies (most often against the dollar or the euro). In simpler words, this economic phenomenon can be explained as follows: yesterday for 100 rubles you could buy 10 units of a certain product on the world market, and today only 9 units of the same product.

In addition, devaluation is not only a processbut also a national currency management tool. In this context, the term is used in research papers and reports of the IMF (International Monetary Fund).

Currency devaluation almost always leads tothe rise in price of essential goods (in particular, food) and real estate. Often, the devaluation is followed by its faithful companion - inflation, and there is a rise in prices for absolutely all goods and services in the country.

Devaluation and inflation: correlation of concepts

Inflation is also associated with a decreasepurchasing power. But its main difference lies in the fact that it devalues the national currency in the domestic market (that is, in relation to local goods and services), while devaluation does the same with the domestic currency on the world stage.

Very often, devaluation isprimary, provoking inflation. But these two processes can exist autonomously. So, devaluation is possible without inflation in the event that foreign currencies at this moment are subject to deflation (decrease in the general price level).

Devaluation is always strong (verytangible), large-scale and long-term decline in the national currency. Inflation, in turn, is often short-lived and can capture only certain regions of a state. Plus, inflation is always a spontaneous and uncontrollable phenomenon, in contrast to devaluation, which can be caused by artificial means.

Devaluation and revaluation

Revaluation is a phenomenon diametricallythe opposite of devaluation. Its definition can be summarized as follows: this is the rise (strengthening) of the intra-national currency rate. What does this mean for ordinary citizens? First of all, for them it is an incentive to acquire foreign currency, which is losing its position.

The national economy as a whole revaluation promisesstability and flourishing. In other words, foreign investors will begin to arrive in the country and invest their money in local enterprises and projects.

But there is a revaluation and its negative side.So, its too high rates absolutely will not contribute to the growth of the national economy. After all, imported goods will rush to the domestic market, which will certainly hit domestic producers.

Causes of devaluation

The fall of the national currency may becaused by both macroeconomic and domestic political factors. For example, devaluation is often the result of systematic actions by regulatory authorities in a given state. In this case, it will be considered artificial.

Let's list the possible objective reasons for the devaluation:

- Military actions and conflicts.

- International sanctions.

- Mass outflow of capital abroad.

- The sharp fall in prices for raw materials exported by the state.

- Reduction in bank lending in the country.

- General economic or political instability.

- The inclusion of "printing press".

- Seasonal factors (for example, a temporary decline in business and entrepreneurial activity).

Many people ask a legitimate question: is it possible to somehow save your money from devaluation? There are at least two ways to save your hard earned money:

- Savings are best kept in a solid, stable currency.

- Money in any case should not be stored "under the mattress." They need to be invested in something (at least in a bank, so that deposit interest covers possible exchange rate fluctuations).

Devaluation and its consequences

Нетрудно догадаться, что при снижении курса The national currency is most affected by those enterprises that purchase raw materials for their production cycles abroad. This will always lead to a significant increase in the cost of their final product.

In general, the following negative effects of devaluation on the national economy can be identified:

- Significant increase in inflation.

- Reduced confidence in the domestic currency among the population.

- Total hibernation (slowdown) of all business activities.

- Depression in the financial sector of the country.

- Rising prices for imported goods and, as a result, import substitution.

- The risk of bankruptcy of those enterprises that operate on foreign raw materials or equipment.

- Depreciation of deposits in national currency.

- Decrease in consumer activity of citizens.

However, devaluation has its positive sides. But we will tell about them a little later.

Types of devaluation

In economic theory, there are two main types of devaluation:

- Official (or open).

- Hidden.

With an open devaluation, the main financialthe institution of the country officially announces the depreciation of the national currency. At the same time, all the nuances and all changes in the exchange rate are completely open to the public. At the same time, discounted banknotes are either withdrawn from circulation or exchanged for new ones. An open devaluation, as a rule, occurs rather quickly - in just a few hours.

Hidden devaluation takes place without anypublic statements or comments of the authorities. At the same time, the devalued money is not withdrawn from circulation. Such a devaluation can continue for a long time, up to several years in a row.

Open devaluation often causes a decrease in commodity prices, but a closed one, on the contrary, provokes their rapid growth.

Examples of economic devaluation

Яркий пример девальвации в Европе – резкое the fall of the pound sterling and the Italian lira in the early 1990s (in relation to the German mark - by 12% and 7%, respectively). After that, by the way, both Italy and the UK announced their withdrawal from the European Monetary System.

What year was the devaluation of the ruble?Since 1991 there have been at least three such episodes: in 1994, 1998 and 2014. The ruble, by the way, is one of the oldest European currencies. For the first time his course was defined in the XIII century. However, today it can hardly be counted among the list of European hard currencies.

День 11 октября 1994 года вошел в историю России like "black tuesday." Then the Russian ruble made a steep dive, falling as much as 27% in one day. The country plunged into a period of chronic inflation and a prolonged economic crisis. By the end of 1996, for one US dollar gave about 5,500 thousand rubles! The following year, the Russian government held a denomination, discarding three signs from this huge amount.

The last devaluation of the ruble is still fresh in memorymany citizens of Russia. It happened at the end of 2014. In general, this year the Russian ruble lost half of its value (the rate collapsed from 34 to 68 rubles for one dollar). The fall in oil prices and international sanctions against the background of the country's raw material economy were the main reasons for this devaluation.

The devaluation of the ruble in 2014 shocked many.But everything, as they say, is cognized and realized in comparison. Thus, in Turkey, the lira continuously fell for two decades (from 1980 to 2002). During this time, the local currency has overcome the path from 80 to 1.6 million lire per dollar.

Benefits of devaluation

В сознании многих людей прочно закрепился the stereotype that devaluation is a real disaster and a catastrophe for the national economy. However, this is not quite true. Rather, devaluation is not always bad and not for everyone. We will understand this issue in more detail.

Прежде всего, во время девальвации растет спрос on products of domestic production. The explanation is simple: owners of depreciated national currency can no longer afford imported goods and are beginning to look closely at similar products produced in their homeland. This may ultimately lead to an increase in the competitiveness of the national economy. But only with the simultaneous implementation of real and structural reforms by the authorities.

There are several possible positive points of devaluation. Among them:

- Growth in domestic production.

- Reducing the balance of payments deficit.

- Reducing the rate of waste of foreign exchange reserves of the state.

Who is at a loss, and who is in profit?

Win from devaluation, first of all,exporting companies that pay taxes and wages to their workers in national currency, and receive revenues in foreign currency. Including the winners are the economies of those countries whose production is focused on the export of raw materials and cheap products. Here it is appropriate to cite the example of China. As soon as the economy of the Middle Kingdom began to slow down, the government immediately began an artificial devaluation of the yuan.

All other market participants, alas, cancategorized as losers. And ordinary ordinary citizens who are directly affected by rising prices for consumer goods are most vulnerable. On them devaluation always hits the hardest.

Conclusion

Что такое девальвация?In simple words, this is the process of devaluing national money against foreign hard currencies (euro, dollar, Japanese yen, British pound). The opposite process of devaluation is called revaluation.

Среди основных причин девальвации можно выделить the following: wars, sanctions, capital flight, reduction of bank lending to businesses, lower prices for exported raw materials. Devaluation can lead to rather sad consequences. In particular, it significantly reduces the level of public confidence in the domestic currency, devalues people's long-term savings, leads to a total depression of business and financial activities in the country.