Among the many electronic payment systems,existing on the Internet, stands alone the largest and most reliable - PayPal. What is "PayPal" and how to use it, are payments really protected? For the vast majority of people, this is unquestionable, but they linger on registration, voluntarily limiting themselves to the opportunities that the system gives. For an inexperienced user, PayPal seems to be an extremely complex service, but it's not so terrible in fact, and it's worth spending a little time and figuring out, because the merits of the system are really great.

The appearance of the PayPal payment system

Its work is unique in its own way.Despite the fact that this is not a bank, but a debit system, it is subject to all laws that operate in the banking sector. The company's activities are licensed in many countries of the world. In Australia, for example, the company received a special bank loan-savings license.

PayPal Corporation appeared in March 2000 andfor a short time managed to win the trust of customers. Perhaps, few similar companies have invested in customers as much as PayPal did. What are they doing to win the competition? In its own unique and aggressive strategy, requiring large investments - it was offered $ 20 for each client involved.

Initially, the system was focused onelectronic auctions of not less large company eBay which two years after creation has absorbed PayPal. This coordinated work lasted long enough, and only at the beginning of 2015 the companies were divided again. In the competitive struggle for the international electronic payment market, PayPal has become an absolute leader.

Advantages of the payment system

Users who have been for many yearsfans of "PayPal", singled out several main advantages, and first of all it is reliability and speed of payments, regardless of the country in which the counterparty is located.

Of course, compared to many othersPayPal is the most rigorous system. What is, for example, the dispute between users, if the transaction is not completed? The dispute between the buyer and the seller allows you to come to a decision that would suit both, but if the parties do not agree, the dispute goes into a claim that will be reviewed by PayPal employees. Such tools really scare away some users, but it is these complexities that are designed to ensure the security of transactions. Thus, the restriction turns into an advantage.

It is "PayPal" that makes it possible to conduct transactionsdifferent kinds without bank transfers or currency exchange. However, the exchange will have to be done if you need to deposit money into your PayPal account or withdraw funds to a bank card.

Features of using PayPal in Russia and CIS countries

Different countries have different status in the system withtolerances and limitations. Until recently, the Russian PayPal differed in that it was possible only to contribute funds to the account and pay for it with the help of purchases through the Internet. In particular, for purchases on such major resources as eBay or AliExpress. But there was no way to withdraw funds from the system. Similar restrictions apply to all CIS countries to varying degrees. However, more recently, Russia has received an increase in status, and now Russians have the opportunity not only to pay for purchases, but also to withdraw funds to the card.

Somewhat worse things are in Ukraine and inOf Belarus. Kazakhstan has recently joined the system and is also in the zone of functional restrictions. Probably, in the near future, residents of these countries will also have expanded opportunities. After all, if we consider the payment system as a tool, then PayPal will be among the most convenient mechanisms that expand the boundaries. What is a relatively short wait compared to the ability to send and receive payments instantly across the world?

Signing up for PayPal

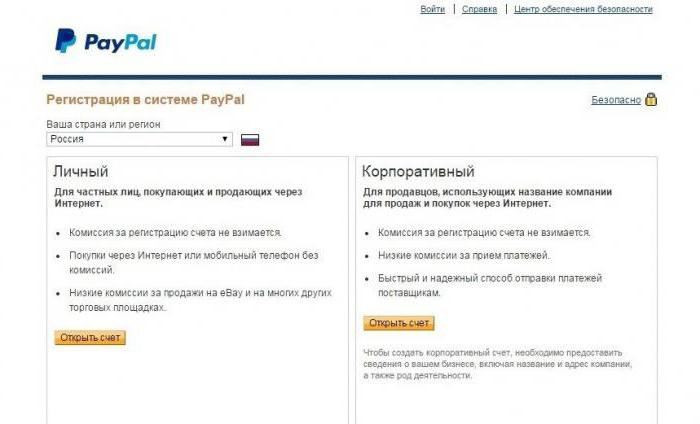

To start using the system, you need to passsimple registration. This is a free service, you do not need to make any separate payments. It is important to know that when registering you need to specify your real data, if you enter them with errors or come up with an alias, then during verification, the account will be recognized as fake and as a result will be blocked. That's why any instruction on how to set up PayPal without making real data is certainly wrong and can lead to account blocking.

Before registering, you need to decide whichstatus you want to work with the system: as a buyer or as a businessman. The usual account of the buyer is issued free of charge, then there is the opportunity to move to the next level, if there is such a desire.

After selecting the country and the user statusyou will need to enter the e-mail address, password and mail address, and also you need to bind a bank card - this is how PayPal works. How to use the payment service? This is possible only through a tied bank card, which must be opened in the name specified at the time of registration.

Binding a bank card

Another important step necessary to beginwork with the system, this is the binding of the bank card to the account. This is done so that you can use the money in your account to pay for various goods and services on the Internet, it is on this card that you can withdraw money from the system.

You need to enter a number, expiration date and code,located on the back of the card. After that, the system will begin to check it. It is desirable that this is not a credit card, but a debit, that is, a payment card. PayPal withdraws a small amount of money from the card to verify the very possibility of contact and transfer of funds. Usually this is $ 1.9, and this is not a fee for services. After the cardholder confirms that the withdrawal of money is made with his knowledge and is legitimate, the card is confirmed and the funds are returned to the bank account.

Payment for purchases and payments

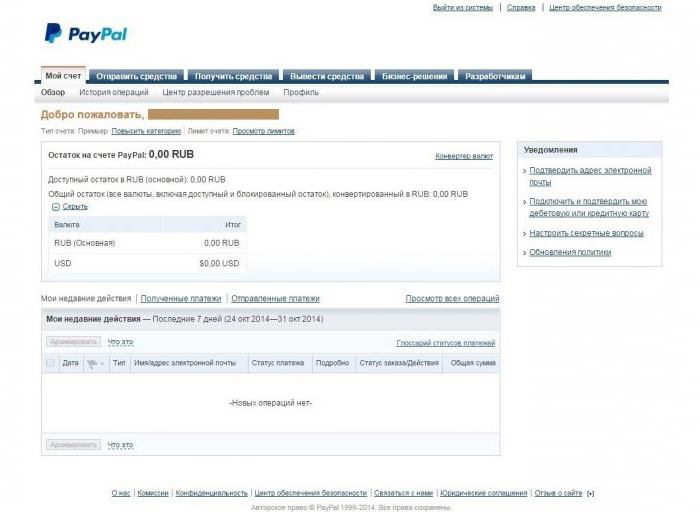

The most convenient thing in this system is that the interfaceas customer-oriented as possible, he is really friendly. Simple design is intuitive, when registering the required language, so for a Russian-speaking user without knowledge of English there are no difficulties. Setting up PayPal allows you to send money in just a few clicks. Separately, you do not need to enter funds into the system, PayPal connects to the attached card and takes them from it.

To send money to another userThe system only needs to know its identifier, that is, the e-mail address. An important nuance: Russian citizens can only send rubles in mutual settlements, with other countries the calculation is in dollars.

To receive money within the establishedmonth limit does not need to be registered as a businessman or a commercial company, this is required only if within the limit it becomes crowded and a more dense turnover of funds is needed. Money is transferred almost instantly.

PayPal features: limits and security

The limit of funds that can be used insystem PayPal, depends on the level of verification of the account. If you use an unconfirmed account, the user can spend or accept no more than 15 thousand rubles or a currency equivalent of the specified amount per day. The monthly limit for the movement of funds on the account is 40 thousand rubles. Such restrictions for security reasons imposes on the users the system PayPal. How to use more freedom and expand the limit? It's enough to pass the account verification.

There are two types of verification in the system:simplified and complete. After passing the simplified limit increases to 60 thousand rubles per day and up to 200 thousand per month. Full verification makes it possible to send a single payment up to 550 thousand rubles, this greatly expands the user's capabilities.

How do I complete my account verification?

To obtain maximum financial freedom inthe system must fully confirm its identity. Here is an up-to-date list of information that the PayPal user provides for complete identification, the instruction is extremely simple:

- passport data;

- Mobile phone number;

- number of state registration to choose from (insurance number of the personal account in the bank, TIN, number of the policy of compulsory medical insurance).

Such schemes of user identification are available in almost all large enough payment systems.

PayPal commission

When sending money orders, the PayPal servicecharges a commission depending on the amount transferred. To ensure that after the completion of the transaction, do not be surprised at the spending that has grown, it is recommended to specify the full amount of the payment, that is, together with the commission.

Pay for something in rubles, that is withinRussia, or send a remittance within the country can be without commission, but subject to the use of funds that are on the internal account of PayPal. If the money for the money transfer system should be taken from a bank card, the commission is 3.4% of the transfer amount and 10 rubles for a separate transaction.

When transferring abroad, it is chargedadditional commission. Depending on the recipient's country, the commission is from 0.4% to 1.5%. However, it is possible to choose the payer of the commission fee, it can be paid by both the sender and the transferee. When carrying out any operation, the system will offer you to familiarize yourself with the list of commission fees.

Additional security guarantees for transactions

As part of the fight against fraudulent schemes anddeception of buyers in the system PayPal provides for the blocking of payment until the buyer confirms receipt of the goods. Only after that the seller gets access to his profits. Perhaps, it will seem to someone superfluously strict, but the PayPal reviews confirm that this approach fully justifies itself. In the event that the buyer does not receive the goods or he does not comply with the declared description, he is entitled to challenge the transaction within 45 days.

Withdrawing money

Until recently, there was no possibility in Russiawithdraw money from the system, so there was a lot of Internet services that offered this service on a fee basis. The commission for such a transaction is quite high, so when setting up a business on the Internet, this had to be taken into account. At the moment, exchange sites are used by citizens of other CIS countries, if there is a need to get money to your bank account or to another payment system from PayPal. Customer feedback confirms - the services really work, but the commission is not happy.

However, at the moment in Russia there is an opportunitywithout interest and any overpayments to withdraw money to the bank account. It is enough to select "withdraw funds" from the menu, the system itself will offer your bank account. The only inconvenience - the operation takes 5 to 7 working days. By e-mail, a notification is necessarily sent.

In PayPal there is nothing difficult - expand your capabilities!